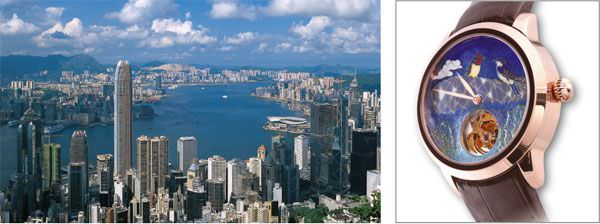

Complications in watches such as tourbillons and complex add-ons have long been the preserve of the Swiss but these specialities are now emerging from high-end Chinese manufacturers who released their new exquisite creations at the September 2008 Hong Kong Watch & Clock Fair.

What do the Chinese buy?

Recognised watch brands on the China mainland bear little relation to the brands we know from Switzerland, Europe and Japan. Mainlanders are familiar with brands such as Sea-Gull, Shanghai Watch, Beijing Watch, Fiyta, Rossini, EverBright and TianWang. Watches made in China range from Ä45,000 for the Sea-Gull rose gold minute repeater to glitzy funkies for under Ä2 each. China produces some 80 per cent of the world's clocks and watches, but the value is less than 10 per cent of the global total.

Assessing the scale of the Chinese mainland market beyond broad generalities is very difficult. Consider that Shanghai central business district on a regular working day is feeding and supporting 20 million people and this is but one of the myriad of mainland Chinese 'markets'.

Established classic Swiss brands are preferred by those who can afford them and watch industry researchers in China estimate that the market could absorb 15 million mid and high-end watches every year.

Beijing Watch, ‘Swallow’ tourbillon with free-sprung balance, 18 carat rose gold, sapphire crystal glass, gold hands, cloisonné enamel dial, padded and stitched crocodile strap, water resistant to 30 metres, special presentation box with precious metals identification certificate. Made to order but limited to 50 pieces - expect to pay ¤ 11,000.

The established Swiss brands

Given these circumstances is it any wonder that Omega, Rolex, Piaget, Tiffany and many other prestigious brands have their names emblazoned in neon over their exclusive shops on the main drag in Shanghai?

Some appreciation of the importance of China to Omega and the Swatch Group can be gauged by the fact that the company has licensed 170 stores on the Chinese mainland, Hong Kong and Macao to sell its products. Omega, by far the earliest into China (in 1895), opened its largest flagship store in 2005 in Shanghai with 450 square metres of floor space on two levels.

Further indications of the internationalisation of the Chinese comes from a spokesman at China International Travel Services who said “Chinese tourists like shopping. Every tourist, if visiting Switzerland, would buy a Rolex or Rado.” According to statistics, an average Chinese tourist in 2006 spent US$987 on shopping which is even higher than an average Japanese tourist. The increasing affluence of China’s burgeoning middle class is a crucial factor. Luxury items are particularly popular because most travellers to Europe are more prosperous business people or senior officials who want to save 20 to 30 per cent over the price charged for these high-duty products in China.

The special role of Hong Kong

However the Hong Kong based watch com-panies with their cherished Western connections identify with the markets of the United States, Japan, Asia, Switzerland and the European Union. And with the prestige deriving from this, the Hong Kong companies are trusted suppliers of quality Hong Kong watches back into mainland China even though these self-same watches were manufactured in the Pearl River delta area – the industrial engine-room of southern mainland China.

This is a somewhat circular phenomenon creating an enduring statistical headache.

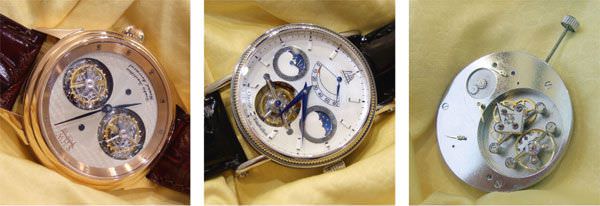

Shanghai Watch Ind Co double flying tourbillon, hand wound 21600Hz in a solid 18 carat rose gold case, blued hands over a silvered dial, Arabic hours engraved on the internal gold bezel dress-ring. Black alligator strap.

From Shanghai Watch the ‘Classic Tourbillon’ with clear open style, power reserve, calendar indications and steel case reflective of the current construction of high-end German and Swiss makers.

PTS Resources exhibited this self winding calibre with karrusel. The 12Hr karrusel carries the hour indications and the subsidiary hands are power reserve, minute hand and GMT/dual time.

The size and scope of the Mainland Chinese market

The population of China is 1.3 billion people who, by average western values, would be categorized at subsistence level. Averages however are deceptive generalisations. Consider that across all China the average annual wage is a little under US$1,000 but the average in Shanghai is US$4,900, one per cent earn over US$100,000 and across China more than 100 individuals own personal assets of US$100 million or more.

The showcase of Shanghai is a glittering, charismatic city but underlying China today is a complex matrix of fantastic contradictions. Our cold war preconception of this country has been turned on its head by the raw energy of change sweeping the mainland and Shanghai particularly.

There are 400 million Chinese living in the greater Shanghai area and as mentioned, one per cent of these (four million people) have an annual income exceeding US$100,000. Thus a low percentage of wealthy people is nevertheless a large market for luxury goods when the sheer volume of humanity is fully comprehended.

There are estimated to be more than 10,000 retail jewellers in China today and there is no concession to average incomes as prices are no less than we might expect in western retail outlets for the same branded items. Sales of watches and jewellery to mainland Chinese are estimated by the Hong Kong Jewellery Manufacturers Association to be growing at five to ten per cent per annum (2006).

Beyond all expectation mainland Chinese have adopted staunchly western commercial institutions and our classic European brand names with great enthusiasm right across the country. Examples are St Valentine’s Day and Christmas Day which are considered to be days when jewellery gifts are decidedly appropriate – much to the joy of the retailers.

The first Chinese tourbillon

Kiu Tai Yu, born in 1946 in Soochow, China, discovered his talent at an early age for fixing broken watches and clocks. Entirely self-taught, he built his first watch at the young age of 23 and on his 45th birthday in 1991, Kiu Tai Yu astonished the horological world by making the first Asian tourbillon entirely on his own.

The last time China made any impact on the horological world was about 10 centuries ago when Su Song, an imperial attendant was commissioned by the Dragon Throne to construct a time measuring instrument as a standard for the Celestial Kingdom. His ingenious solution was a water clock, the first timepiece ever to have a mechanical escapement and is perhaps, tenuously, the indirect ancestor of today's Rolex.

Sea-Gull Minute Repeater Ref. ST9100G in 18 carat gold, limited edition, gold Breguet style hands on a silvered dial, raised Roman numerals and raised small seconds at 4.30 position, Domed sapphire crystal, stitched brown alligator strap, water resistant to 30 metres, crystal see-through back. Expect to pay about 45,000 euros.

Sea-Gull Minute Repeater Ref. ST9100G movement through the back. Note the good decorative spotting but no anglage and disproportionate crossing-out of the centre wheel and third wheel.

From Sea-Gull comes this 18 carat gold double tourbillon with Roman numerals on a silvered white guilloché dial. The movement is 33.8 mm diameter with a thickness of 5.9 mm, 42 jewels, frequency of 21600Hz, hour and minute hands at centre, coaxial tourbillon at 6 o'clock and off-centre tourbillon at 9 o'clock. Expect to pay about 32,000 euros.

The first series production Chinese tourbillon

PTS Resources was one of the first Chinese watch companies to exhibit a tourbillon in 2003/4 and philosophically this was a real contradiction. The purpose of making tourbillons today is to exhibit the maker's skills rather than improve the positional rate of a watch.

Materials technology in relation to isochron-ism and dynamic balancing are now so well understood that exceedingly good timekeeping is available without recourse to such re-latively crude error-equalisation devices as tourbillons. They are more demanding to make, sensitive to adjust and beautiful to observe, but like tapered mainsprings and (unmatched) fusees they really do little, today, to assist good timekeeping. So the first Chinese tourbillons simply declared to collectors ‘we can do this too!’ but the finish was not in keeping with the spirit and even the untrained eye needed no assistance to make valid comparisons.

Finish and innovation

However that was five years ago – and now we are seeing the rewards of their persistence in a vast improvement of the finish of the plates and components. PTS may even be getting a bit bored with tourbillons as last year they exhi-bited a self winding 12 hour karussel with power reserve and dual time indications. The 12 hour karrusel has been given the hours indication function and there is a separate minute hand. Clearly with such a long revolve time the karrusel won't be doing too much positional correction but like the tourbillon it was ‘there to be done’ and PTS have made a nice job of it.

Production tourbillons

Sea-Gull's double flying tourbillon of 2007 has balance wheels of different size which share the same driving train. The explanation as to why the balance wheels are of different diameter is that Sea-Gull is displaying its first and second generation tourbillon developments in the one watch and indeed this can be seen in the improved finish and fineness of the 6 o'clock tourbillon over that at the 9 o'clock position.

Also exhibiting a double tourbillon was The Shanghai Watch Ind Co Ltd which is another long established watchmaking firm which describes its manufacture program to include “automatic, multifunction, power reserve, chronograph and tourbillon watches”.

Beijing Watch is claiming the first double tourbillon watch in China with “flexible moment differential”.

The watches from these makers are exquisitely finished and we start to really feel they are watching the quality coming out of Switzerland and are learning the finer points along the way.

In a couple more years the differences between Swiss and Chinese craftsmanship may not be so easily seen.

Sea-Gull's minute repeater is the highlight

This year the highlight of the Hong Kong Watch and Clock Fair was the first Chinese minute repeater brought to the show by Sea-Gull, the biggest Chinese maker and reported to produce a quarter of the worlds mechanical movements. ‘The Chinese Minute Repeater Watch’ (proclaimed on the caseback) makes a very beautiful, uncluttered, sophisticated statement. But it would be interesting indeed to see the finish of the repeater mechanism behind the dial.

What we can see through the back is a huge advance of quality and finish but lacking the Swiss understanding of class, proportion and detail. The plates are nicely decorated with good spotting but bevelling of the edges or anglage polishing is absent – and this may be a conscious choice, but western eyes may prefer the traditional 'Swiss' finish.

We can see the centre wheel and third wheel and the crossing-out leaves the spokes and wheel rims thicker than we might expect. And we would assume that the arbor ends should be domed and polished. Perhaps more difficult than the 'doing' is understanding the con-ditioning of the minds of buyers in the Swiss tradition reaching back over many generations.

Watches are bought at two levels

In past years we all had one ‘Swiss Made’ watch of good quality. Today many consumers still maintain one prestige quality watch but may have half a dozen others in the bureau drawer bought cheaply at opportune moments or simply on impulse. This wide availability of inexpensive wristwatches follows the advent of the quartz revolution which has created two quite separate segments in todays global watch market.

Hong Kong, indulging its symbiotic CEPA manufacturing relationship with China, is making a huge volume of lifestyle/inexpensive watches. Switzerland for its part firmly grips the high-end ‘Swiss Made’ epithet of the last seven decades, setting all-time records in rising value.

Significantly, Swiss production of traditional mechanical watches accounts for only 14 per cent of the total units – but over 62 per cent of its total value – and this pattern is indicative as well, for Hong Kong and mainland makers.

Brand recognition

But Hong Kong also makes watches of high quality as does Switzerland of lesser quality. Hong Kong makers are now striving for greater brand recognition to reap some of the benefit of higher retail price points coupled with good quality manufacture – and ‘China Made’ is to mainland China, the world’s biggest market, as ‘Swiss Made’ is to the rest of the world.

Subtleties of marketing evolution

Where previously Europe imported watches bearing the label ‘Made in Hong Kong’ we then saw ‘Made in China’ and now, in the steps of the Swiss, ‘China Made’.

This emulates but does not threaten the ‘Swiss Made’ ascendency which has steadily built its strength on the high, up-market range of mechanical watches. If threatened the Swiss will go further up-market with mechanicals which already command breathtaking prices from makers with pedigree and a venerable reputation to entice and hold their buyers.

The Chinese are capable and dedicated but the Swiss are not losing any sleep.

The Swiss and the Chinese makers

Hong Kong suffers a mild intimidation on the one hand from Swiss companies, which are endowed with famous brand names, goodwill and expertise and on the other hand from Japanese manufacturers whose edge relies on technical reliability and large-scale automation.

But these are perceptions rather than realities. The year-by-year advances in quality, finish, innovation, style and technology are completely outstripping series manufacture from Japanese, European and western sources.

There are some exquisite Chinese watches in the high-end price category and the makers have an appreciation for fine ‘watch culture’ but this has not yet fully matured in its translation to the immaculate finish which collectors have come to expect.

Perhaps this is only a question of time.

Source: Europa Star October-November 2008 Magazine Issue