The US market is the leading market in the world for most goods, and watches are no exception – it is one of the biggest and most important markets in the entire world. To borrow an old adage, when the American market sneezes, the rest of the world catches a cold.

Well, the US market doesn’t just have the sniffles, it’s in the throes of a full-blown bout of influenza.

U.S President Barak Obama, Bozeman Watch Company

Though some economists are loathe to use the word, most people are finally ready to admit that the US is in the grips of a recession.

Let’s deal with the most important, and pres-sing, questions on everyone’s minds: Is it as bad as people say it is? And How long will it last? The questions, respectively, are ‘yes and no’ and ‘no one knows’.

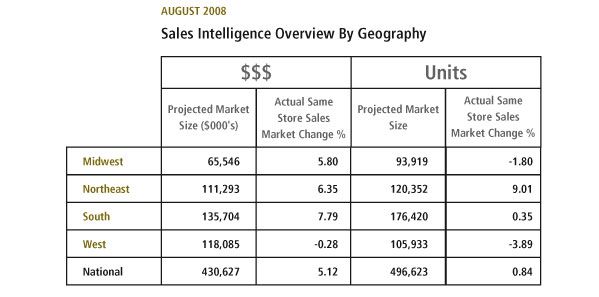

Surprisingly, retailers and brands are split on what they are feeling. Some retailers are still going strong, while others are struggling. Some price points are not feeling the slow- down at all and others are hurting bad.

The General Economy:

Right now, all signs point to this period as being one of the toughest economies in decades. Consumer confidence is at a very low point, the stock market has crashed again and again and there has been a precipitous drop in retail sales.

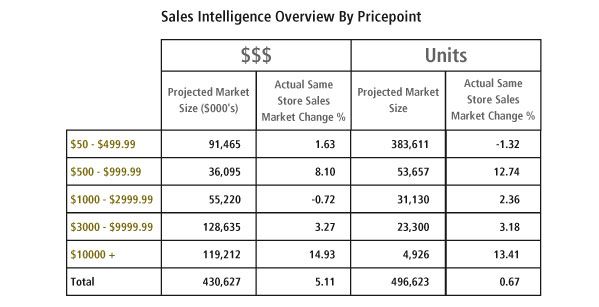

“I think overall, economically, Wall Street hates uncertainty,” Andy Talbert, COO, LGI Network says. “I think things will get more stable and now that the election is decided, things will start to get better, but it might take a long time. When the market goes down, even people not in the market feel poor and they don’t want to spend so much. If things improve, the people who have jobs and feel secure will probably increase their spending. People are nervous now, though. The price points for watches that have really been hurt have been $800 - $1,500, because are people really going to spend those dollars on watches when food prices are so high?”

From a brand perspective, retailers are being very cautious when it comes to ordering and re-ordering. “Needless to say, the most recent economic events have created a very cautious environment with our retailers,” says Rudy Chavez, president, Baume & Mercier North America (NA). “In the short term they are buying much more conservatively and not building their holiday inventories as in years past. A completely understandable and pragmatic approach given the circumstances. The uncertainty of the upcoming holiday season has prompted many retailers to evaluate their business very closely. They will determine their true partners and how their brand portfolio will evolve.”

The Chosen One:

Now that Barak Obama has been chosen as president, there is hope that the uncertainty that has plagued the markets and business in general will disappear. After all, “the devil you know...”

Many small businesses are holding their collective breaths however, as a Democrat in office typically means more taxes. Expectations are that Obama will raise capital gains taxes, which could freeze the sale of taxable assets like real estate. At the same time, however, Federal interest rates have already been cut to low levels, hoping against hope that banks will start lending again and people will start buying houses and more.

In general, Americans are hopeful that the country has turned a corner with the election of Barak Obama. There is a new hope that things will be different. Whether it will, well, only time will tell.

“I believe that this weak economy will last one to five years, realistically,” Denis Boulle, owner, deBoulle, says. “The election will have a minor effect but consumers will still be conservative with their disposable income.”

Patek Philippe at Tiffany’s

Luxury Still Strong

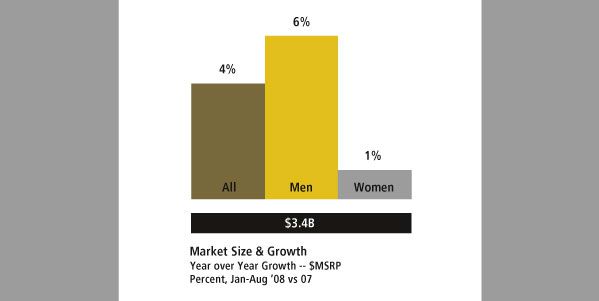

Despite the difficult economic times, those brands and retailers working at the top level of the market are still having a pretty good year. Though traffic is certainly down across the board, sales of truly expensive pieces are still strong.

“Everybody is a bit soft,” says Milton Pedraza, CEO, the Luxury Institute. “The more classic the watch is, like a Patek Philippe or a Vacheron Constantin, the more likely they are to be coveted and purchased. What’s happened with this crisis, if you want to buy a luxury watch, you want to make sure it will retain its prestige and its value. The watches that are highly regarded, unique and exclusive, and that are innovators in a way that is substantive, will do well. They will survive and thrive through this downturn. Watches that are more marginal because they are not as valued, were purchased mainly by customers that weren’t really wealthy people. Vintage watches, the ones that are collector’s items, will do well: they might be down over last year, but still do well. We expect overall business to be down about 5% over last year. A brand that succeeds may have to bring prices down.”

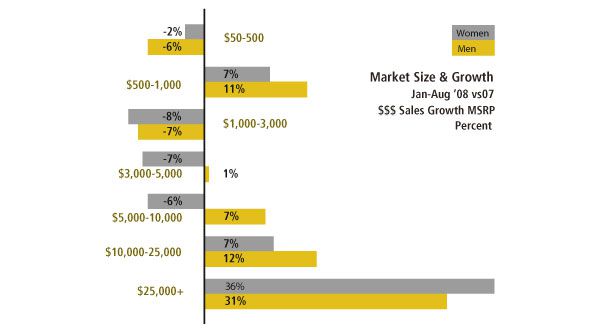

At the highest end of the business, sales are continuing to be strong. “Business has been very good for us in 2008, we are trending at an over 20% increase over last years amazing results,” says Douglas C. Bradstreet, Jewelry/Watch Buyer, Wynn Las Vegas. “We don’t see any slowing down with our momentum at this time. The economy has forced us to change the way we do business a bit. We are very proactive in exchanging lower priced product ($10,000 and under) for much higher priced point product such as diamonds and watches over $25,000. This has enabled our sales to increase while the daily average transaction count has decreased a bit...so we have done exceptionally well regardless of the economy.”

Brands that have limited product are perhaps in the best position, as their watches are constantly in demand, regardless of market conditions. “Business is steady despite the very difficult financial crisis,” says Larry Pettinelli, president, Patek Philippe USA. “The limited supply of Patek Philippe timepieces in the market helps in keeping consumer interest high. Our retailers are starting to feel some concern overall due to the economic times but are hopeful that this is a temporary situation.

“At this point in time, individuals who have been waiting six to eight months for timepiece deliveries are still anxious for the pieces,” he continues. “Patek Philippe watches have never been an impulse buy. From a consumer standpoint, there is a great deal of research that is conducted prior to purchase and individuals are therefore less deterred by market fluctuations.”

“This year will still be better than last year for us,” echoes John Simonian, owner, Westime. “We had a tremendous first nine months and the downturn will just take a small bite for the year. Second, the segment we positioned ourselves into is so unique and limited and very high priced that there is still a market (very small but solid) out there with very little competition. For years the demand largely exceeded the supply in the ultra high end, maybe now, it will level off.”

Consumer spending in the US is at a particularly low point, so even brands doing well know that it’s not indicative of how the overall market is. “We are having a good year at Zenith but are well aware of the fact that we are not representative of the overall business landscape,” says Paul Ziff, president, Zenith NA. “We only cater to a couple of thousand clients per year who can purchase our watches, so to say that it is not a cross section of America is an understatement.”

The tendency for retailers is to start pulling back, because while higher-end watches are still selling, the moneymakers for most retailers are the volume watches, the timepieces they can turn several times a year. “The business right now is beginning to be a little blocked by the retailers, who are on the brakes,” says Girard-Perregaux/JeanRichard NA’s president, Ron Jackson. “There are retailers who are very cautious and pessimistic and they are really trying to manage their receivables and their cash flow. Everyone says that under $10,000 is much more difficult than over $10,000. That under $10,000 is an important segment for them, and when they are missing that segment, it hurts their cash flow.”

How’s Business?

The answer to this question depends on where you are and what you are selling. Retailers who are selling lower priced watches are struggling, and even those who are selling timepieces in the $1,000 to $10,000 range are finding the going tough.

Retailers in the true low end, in the $100 - $400 range, are doing pretty well, as these prices are still affordable, no matter what the economy. It’s when the price creeps up around the $1,000 range that things get tough. At this price range, people compare the cost of the watch to their mortgage payment or the number of times they can fill up their car, and often put their wallet back into their pockets.

In the past, people buying more expensive watches could be expected to drop down and buy timepieces priced more reasonably, but that has not been the case so far. These people, who are more educated about watches in general, are not buying less expensive, less well-finished watches, they are doing one of two things – buying true classics, even if they are more expensive, trusting that these pieces are worth the money and will hold their value; or they are not buying anything.

“Certainly we have noticed an overall slow down in the luxury category and a cautious look at inventory levels,” says Stacie Orloff, president, Bell & Ross NA. “However, sales remain very strong in our core Instrument family.

“We are more then happy to work with our retailers to insure we are getting them the inventory they need when they need it.”

Brands that aren’t feeling the slow down are still aware that their important retailer partners are hurting. “So far we have felt it indirectly in the sense that our retailers are feeling a strain,” says Zenith’s Ziff. “They are not making the ‘bread and butter sales’ of $1,000 - $3,000 in jewellery and watches. This is not an area that Zenith is in, but of course we are all connected in the big picture and we need our dealers to be healthy and profitable in all segments so that they can continue to grow in the high end.

“I think that for industry as a whole, the overall business is going to be anywhere from minus 10% to plus 5% over last year,” he continues. “If dealers are flat in their overall business, I think they have done a good job given the economy and, more importantly, the emotional impact of the media constantly pounding bad news at the public.”

Some retailers are feeling the pinch in certain price segments, but are determined to weather the course and attempt to gain market share during this trying time. After all, consumers will still be buying.

“Our middle range lines have slowed down for the time being,” says Candy Udell, president, London Jewelers. “We are being very aggressive in our marketing and advertising because we feel that if clients are still planning to purchase, we want them to think of London Jewelers first. There are still always anniversaries, birthdays, weddings, engagements, Bar and Bat Mitzvahs, Christmas, Hanukkah, Valentine's Day, etc. These occasions are still here even in a tough economy. Our job is to make sure the people shop at London Jewelers and not our competition.”

Levinson Jewelers in Florida opened up a brand new, much larger location at the end of 2008, so they are counting on business to be strong. “We are trying to maintain an ‘up’ attitude,” says Robin Levinson, co-owner of Levinson Jewelers. “We think it will be good because we are moving to a high traffic location and people still want presents. It may even make them feel better to buy something instead of feeling so much gloom.”

Christopher Wardle, CEO of Bozeman Watch Company, one of a handful of American boutique brands, says he is fortunate because his limited production restricts how much he can sell. His company is already up 80% over 2007 and he expects a 100% increase in 2009. “The average one watch buyer has already been impacted by the economy, but fortunately they are not typically our client,” he explains. Bozeman watches range in price from $5000-$5900 and Wardle is positioning the company for gains in the weak economy. “We are using our revenues to expand our technical facility and staff, as well as investing in additional components for future use,” he adds.

The Future

In times of economic distress, there are two kinds of businesses, whether we are talking about brands or retailers: the brave and the cautious. This is not a value judgment, as everyone’s approach is towards one goal - surviving a bad economy. Some companies see this kind of a situation as an opportunity to gain market share, while others just want to wait it out. It really depends on a company’s liquidity and their confidence in their products and services.

After all, if a company boldly increases its spending in a down economy and fails, it’s over. At the same time, a retailer can pull back and try to wait it out, but without any business coming in, it might also be over for them.

London Jewelers, which just completed a major renovation, is bullish on the future. “We have 15,000 square feet of new store space filled with the most luxurious brands in the world,” says London’s Udell. “There is no other store like this anywhere in the world. We offer unique products, excellent unparalleled service and the integrity of a family business that is four generations old. London Jewelers will hopefully challenge all the competition around us with our Watch Salon, walk-in cigar humidor, home dÉcor space, espresso/wine bar, Cartier, Van Cleef & Arpels and David Yurman boutiques, our new Jewelry Salon filled with over thirty designers and a sophisticated Diamond Salon with unique product.”

Watch brands and retailers have to count on consumers seeking out quality and value, regardless of the economy. “We believe that clients will continue to seek quality timepieces,” says Patek Philippe’s Pettinelli. “Perhaps now, more so than ever before. The hand finished nature, small production numbers and exclusive list of Patek Philippe agents leave us with the best possible long-term outlook.”

A challenging economy means that consumers will review their purchases much more carefully, which is good for tried and true brands and maybe not so good for fringe brands.

“I believe that 2009 will be a good year for Baume & Mercier as it relates to market share,” says Chavez. “Consumers will become more selective and brands offering heritage, design, and value will win out. Baume & Mercier is well positioned in each. Our best selling range is between $3000-$5000. We have exhibited incredible growth in this price range, fueled by success of Classima Executives and Diamant. I think it is safe to say that growth will be a function of acquiring market share in the short term and positioning yourself for growth when it turns around.”

Some retailers remain convinced that business across the board will be good. “This year will be better than last,” says Wynn Las Vegas’ Bradstreet. “We are blessed with a clientele base that is very affluent and with the exchange of merchandise that we have done, we are catering to those clients. Our sales continue to grow at a very robust level. Our weakest prices points right now are the pieces under $5,000 and there has been a moderate hit on sales under $10,000. Our strongest price points are the $20,000 plus and then watches over $150,000.

“The future for Wynn and Company is very strong,” he continues. “I believe that surviving and growing our business through these tough times is a sure indicator that we are a very strong and robust company that has a limitless future ahead of us. We continue to seek out the rare and unusual, we continually try to improve upon our customer service and we will never jeopardize our standards.”

Any full recovery for the US economy is far off, but some people see glimmers of hope in the Obama victory. “I think that now we have had the election, we will see the start of a rebound and we will come out of this sometime in the third or fourth quarter 2009,” Zenith’s Ziff says. “We are quite a resilient country and when our confidence in ourselves is restored we will turn things around. I am very optimistic. We live in the greatest country on the planet. We have been through many difficult times and we always come out the other side. I think that the reforms to the financial markets that will come from all of this will be very beneficial in the long term.

“I measure our brand sell-through to see how our specific clients are performing,” he continues. “For an overall sense of the business, I rely on data from companies like LGI which monitor all price points in the watch industry. I also rely heavily on a very ‘advanced technology’ of talking to people. I speak to store owners on a constant basis to find out what's going on in their business. I find out a lot by asking questions and listening to answers.”

London Jewelers

Time to Pull Back?

The biggest question facing retailers and brands is whether to sit back and wait it out, or aggressively attack the US market, which is still under-penetrated. Those retailers and brands that are successful in the struggling economy will be well-positioned for success after the market rebounds.

“People do like to buy watches and there is nice product out there,” says LGI’s Talbot. “Buying won’t stop altogether, but the market will be tougher. I would think that retailers and brands could see this is as an opportunity. “When things get bad, the strong will survive. The brands and retailers who can survive will come out of this stronger. The stores and brands that are proactive and work better. From our data, we see some brands and retailers being more proactive. They are getting smarter and they realize that this could be an opportunity.”

Girard-Perregaux/JeanRichard’s Jackson seconds this thought. “The retailers who are making investments now and continuing their flow of goods and getting the newest products are going to have a much better assortment and in the long term they will be more successful,” he says. “In a down market, the best strategy is to buy. You have to stop being motivated by fear and start being motivated by opportunity.

“I think a lot depends on what happens in the stock market, short term,” Jackson continues. “Right now, part of the biggest problem we face is that the market has changed to people being afraid of investment, afraid it is going to get worse. If the market continues to rally, people will begin to see that the situation is improving. The market will come back, but it might be more prone to buying products like Girard-Perregaux that have a history and a tradition. Some of the products that have been purchased were purchased because they were expensive and people know that, without the history that would back up a product like that. When you look at companies like Patek Philippe and Girard-Perregaux, people understand that the product is a long term product.”

“I believe that 2009 will be tough for many, but great for those that put aside all the negativity in the news and focus on their piece of the economy such as we have done,” Wynn’s Bradstreet says. “We are showing strength when many are showing fear.”

Truth Time

The truth is that no one knows how long the American recession will last. At the same time, however, it’s no good for watch brands and retailers to put their collective heads in the sand and expect to wait it out – it’s a time for calculated spending on verifiable opportunities.

Signs of the Times

![]() DHL plans to cut 9,500 jobs (from 18,500 total) in the U.S.A. and close all of its U.S. ground hubs and reduce the number of its stations from 412 to 103 across the U.S.

DHL plans to cut 9,500 jobs (from 18,500 total) in the U.S.A. and close all of its U.S. ground hubs and reduce the number of its stations from 412 to 103 across the U.S.

![]() Whitehall Jewelers: closing all 373 stores, bankrupt

Whitehall Jewelers: closing all 373 stores, bankrupt

![]() Mrs. Fields chocolate chip cookies, bankrupt

Mrs. Fields chocolate chip cookies, bankrupt

![]() Retail jewellery giant Zales is closing 50 kiosks and 55 stores

Retail jewellery giant Zales is closing 50 kiosks and 55 stores

![]() USA Today reported that among families worth $1 million to $10 million, 76% planned to cut spending. Those worth at least $30 million, only 29% planned to cut spending.

USA Today reported that among families worth $1 million to $10 million, 76% planned to cut spending. Those worth at least $30 million, only 29% planned to cut spending.

![]() A survey by the American Society of Plastic Surgeons said that 59% of doctors saw a drop in cosmetic surgery cases.

A survey by the American Society of Plastic Surgeons said that 59% of doctors saw a drop in cosmetic surgery cases.

![]() According to the Luxury Report 2008 by Unity Marketing, the survey found that affluent consumers, with an average annual income of $209,500, are becoming savvy shoppers. They are shopping strategically and conducting price comparisons. But the survey showed that consumers spent more on average in the third quarter 2008 compared to previous quarters in 15 out of 21 categories.

According to the Luxury Report 2008 by Unity Marketing, the survey found that affluent consumers, with an average annual income of $209,500, are becoming savvy shoppers. They are shopping strategically and conducting price comparisons. But the survey showed that consumers spent more on average in the third quarter 2008 compared to previous quarters in 15 out of 21 categories.

Source: Europa Star December-January 2009 Magazine Issue