It is easy to underestimate Hong Kong’s importance in the global watch trade. Not only is the former British colony the biggest exporter of watch components in the world by value (exports for the first half of 2012 were valued at USD 5.3bn, up 13.5 per cent year on year), it is also the biggest importer of finished watches (valued at USD 5.9bn for the first half of 2012, up 15.5 per cent year on year) and is by far the biggest customer of the Swiss watch industry. As part of our report from this year’s Hong Kong Watch & Clock Show, organised by the Hong Kong Trade & Development Council (HKTDC), we looked a little deeper into the reasons for Hong Kong’s dual role and how changes in the global economy could feed both into and out of this hub and have an impact on the global watch industry as a whole.

The 720 exhibitors from 12 countries present at this year’s show covered the entire spectrum of the watch industry, from cheap watches for children right up to bespoke masterpieces of haute horlogerie and all points in between. You could also find every conceivable accessory or product that might be related to the industry, from movements and leather straps to special photography boxes developed specifically as mini studios for taking photographs of watches, jewellery and other small objects. Thanks to a special gallery organised by Prince Jewellery & Watch Company [see our Retailer Profile by Jean-Luc Adam in this issue], the high-end brands A. Lange & Söhne, Audemars Piguet, Blancpain, Breguet, Chopard, Franck Muller, IWC, Jaeger-LeCoultre, Panerai, Piaget, Roger Dubuis and Ulysse Nardin were also present.

Here we present some of the latest developments from a wide variety of brands, as well as a few new brands who are innovating at the different ends of the watchmaking spectrum.

Burg

Elsewhere in this issue you can read Pierre Maillard’s article about Celsius X VI II, the brand that is incorporating sophisticated mechanical watch movements into high-end mobile telephones. Burg, run by the flamboyant Dutchman Hermen van den Burg, an experienced designer, is doing the opposite, namely incorporating mobile phone technology into a wristwatch.

In Hong Kong the company presented its latest touch-screen watch phone, which even works without a head-set. A test call made at the show proved that the quality is good and, just like a modern smartphone, the watches have a memory for 500 phone numbers, Internet access, MP3/MP4 music player and even a miniature video camera.

But Burg is not aiming to replace the mobile phone. “It’s a secondary phone,” says Mr van den Burg. “Compare it to an iPad. If you have an iPad, you probably still have a computer. Our watch frees you from the constraints of carrying a phone around, but as most people wear a watch you can still have the phone on your wrist.”

Burg designs and assembles its products, which retail for between €125 and €345 at its own 10,000 square-metre factory. After exhibiting at BaselWorld and the Hong Kong fair for the first time this year, Burg is not short of ideas for the future. The company is carrying out trials to sell the watch with a SIM card, just as you would for a mobile phone, and is also thinking of incorporating NFC (near field communication) chips for mobile payments. Talking into your wrist to make a phone call seemed futuristic in Star Trek episodes from the 1970s; it is now a reality.

|

Earnshaw / Cross / Ballast

Mr Vishal Tolani is the Director of Solar Time, which manages the brands Ballast, Cross, Earnshaw and Swiss Eagle. Cross, a brand launched since last year’s show, has been doing well, particularly in Japan and the Middle East, and will be rolling out to markets such as Germany, the UK and the USA in the near future. Since launching last year, Earnshaw has become the number one selling watch on Lufthansa duty free, a market that is very difficult for a watch brand to get into.

“We are mainly an OEM but because of price instability and market erosion we created some brands in order to benefit from what brands have,” says Mr Tolani. “Swiss Eagle developed after Tissot pulled out from a customer. We are seeing more and more of this with retailers and distributors. A company with 50 to 60 doors is a candidate for their own brand.”

Aside from the traditional retail channels and airline duty-free shopping, Solar Time also covers Internet retailing and TV shopping, creating a broad mix of channels. “With Earnshaw we are selling a watch rather than a brand,” explains Tolani. “It is hard for a brand like this to be in a shop window. It is geared towards TV shopping, where the legacy can be explained.”

|

|

|

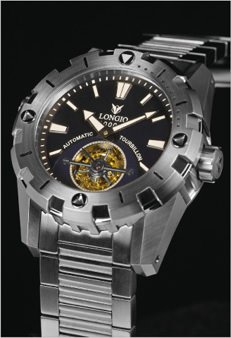

Longio

Hong Kong based brand Longio started life as an OEM/ODM manufacturer in 1996 but started producing watches under its own brand in 2009. The name is a transliteration of the Chinese words “Lun Chau”, which mean “beautiful bridge”. The collection uses ETA 2824 mechanical movements, as well as a Chinese-made tourbillon, and retails for between USD1,500 and USD19,000 for the tourbillon models. All the models have bold designs and a feeling of quality, with one of the highlights being the Telamon, a diver’s watch with a tourbillion, which is water resistant to 1000 metres.

“We have no real competitor and not many other brands are doing the same thing as us,” explains Mi Changhong, the founder and chief designer of the company. “People think that our quality is good compared with other watches.” Look out for a new case design from Longio at BaselWorld next year.

At the Hong Kong Fair, Mr Mi presented the “M.C.H.’s Art of Time” collection, which marries traditional Chinese culture with the best in fine watchmaking. The “National Beauty” model in white gold has a pure black enamel dial overlaid with an intricately carved peony in 18-carat red gold. A symbol of luck, prosperity and happiness, the peony will no doubt confer the same qualities upon the wearer of this watch, which is powered by Technotime’s TT791.50 tourbillon movement and is a limited edition of only 18 pieces. The same Technotime movement powers the “Mythos” unique piece, the case and bracelet of which are carved out of China Hotan superior white jade. Longio claims that this is the only wristwatch in the world to be made from this material and that it took two master jade carvers seven months to complete (one working on the case, the other on the bracelet). A carved 18-carat gold Phoenix takes pride of place on the black enamel dial.

|

|

|

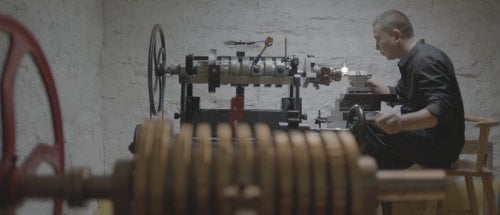

Memorigin

Swiss brands may do well to take note of the name Memorigin. The company proudly announced its first Hong Kong made tourbillon at this year’s fair and, while it is easy to be dismissive of Asia-made tourbillons, the presence on their booth of a Witschi Watch Expert timing device (albeit for display purposes only) among a selection of wood carvings and antique furniture was a hint of how serious the brand takes itself.

William Shum, who founded the brand barely two years ago, explained that he “wanted a brand to reflect China’s cultural tradition. Hong Kong merges eastern and western culture, so I can use elements from both as inspirations for my designs. For the eastern side of things, I already have the culture and, as the brand develops, we have added western cultural references such as our Bruce Lee and Batman models.”

Memorigin also offers its tourbillons as jewellery pieces with 18-carat red or white gold cases and varying levels of skeletonisation and stone settings with up to 212 diamonds set on the case. Even for these top-of-the-range models the prices remain under the HKD 300,000 (approx. CHF 36,000) level. The company has also developed a limited-edition tourbillon of 70 pieces to celebrate the internationally-renowed Hong Kong designer Kan Tai-Keung, who celebrates his 70th birthday this year.

So what about those timing results? Mr Shum claims to be aiming for no less than chronometer levels, with the movements already offering an impressive accuracy of +/- 10 seconds per day.

|

|

o.d.m.

Hong Kong brand o.d.m. is the latest to bring touch-screen technology to a timepiece with its new DD133 Illumi+ series, which combines a simple LED display with a sleek, integrated case and bracelet in a range of both masculine and feminine colours. In one of the most celebrity-studded events at the fair, the collection was presented by a full team from the Hong Kong Rangers FC, the local football club whose shirt sponsor is o.d.m.

British designer Michael Young has added his signature to another touch-screen watch launched by o.d.m. in Hong Kong. The “Sunstitch” watch is solar powered and displays the time digitally either as numerals or hands on its LCD screen, switching modes with a simple tap on the screen.

|

|

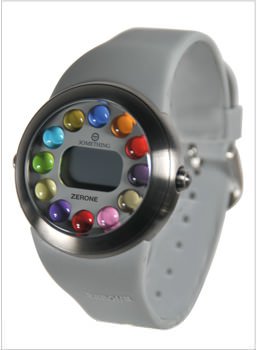

Zerone

One of two brands of Hong Kong-based Z Laboratory Ltd. (the other is upscale Charles Hubert), Zerone occupies a unique position in the world of digital watches with its patented digital module that uses Swarovski crystals to display the digital numbers. The result is a dial on which the crystals magically appear and disappear to indicate the time, or even scroll a special message of choice. This technology is applied to a series of collections based around the “Dazzled” name. The “Dazzled Animation” model in particular is popular as a gift, since it allows the purchaser to input their own special message before offering the gift, and is available in a round, feminine case and a more masculine square design.

Zerone also offers an original model produced in collaboration with Hong Kong’s trendy DJ, singer, actor and designer Jan Lamb, who owns his own fashion brand 30METHING. The “Dot Dot Dot” model has a 43mm stainless-steel case and an acrylic dial that features twelve coloured marble dots. At the touch of a button, LED lights flash under each hour in rotation, stopping at the correct hour position, with the time displayed in a digital read-out in the centre of the dial. The digital module also offers a 1/100th second chronograph, alarm, date and hourly chime and the watch is water resistant to 50 metres.

|

|

The International Watch Forum organised by the Hong Kong Trade and Development Council (HKTDC) at the show brought together representatives from the main countries involved in the production and export of watch components and completed watches for a round table discussion. This offered a rare opportunity to get an overview of the global watch industry and for the speakers to share their views on the current status of the industry and its development over the coming years.

Singling out the feedback from the Federation of Hong Kong Watch Trades & Industries in particular, the expressions of pessimism were much clearer, especially compared with the ambiguity earlier this year at BaselWorld. Although there was handsome growth in the Hong Kong watch industry in the first half of 2012, which is mainly attributable to retailers and distributors replenishing their stocks, things have changed dramatically since the second quarter and the industry expects its worst Christmas for around five years due to the general economic situation.

Until now, the Hong Kong watch industry has managed to keep prices low because material prices reduced, even though salaries increased by around 15 per cent in 2011 and total payroll costs edged up by 20 per cent, as statistics from the HKTDC show. It is unclear, therefore, how long the industry in Hong Kong will be able to compete on price.

|

Added to this is the problem of finding skilled personnel. While there is a readily available supply of watchmakers and machine operators in training in Switzerland and its neighbouring countries, China’s one-child policy means that the population pyramid has been gradually inversing for some time. As Mr Geoffrey Kao, Vice-Chairman of the Federation of Hong Kong Watch Trades & Industries, explains, “In China there is a 4-2-1 formula, by which four grandparents produce two parents, who in turn produce only one child. It will therefore become harder to find cheap labour in China in future.”

Market trends

During the Hong Kong show, the HKTDC surveyed 349 exhibitors and 759 buyers in order to take the pulse of the market. Despite the gloom in some quarters, the survey found that 75 per cent of buyers and 70 per cent of exhibitors expect better or similar business prospects in 2013. But 71 per cent of exhibitors and 64 per cent of buyers also expect production and purchasing costs to rise next year, due to increasing labour costs.

Exhibitors who have set up factories on the mainland said the costs of labour, land, raw materials, taxation and government charges have increased during the past three years and that they would be forced to raise their prices.

The survey also confirmed Europa Star’s impression, after talking to exhibitors, that fashion watches have the best growth potential. It is, of course, important not to equate the buyers scouring the halls in Hong Kong with those doing so in Basel. The majority (74 per cent) of buyers who were surveyed were not agents for brand name watches, but 30 per cent of them said they plan to be, which indicates that there is still potential for growth in this segment.

See the other articles in our report from the 2012 Hong Kong Watch & Clock Show

- The design competition

- Synchronised slow-down

- Morgenwerk launches GPS time

- Hong Kong under the WorldWatchReportTM magnifying glass

- Retailer profile: The Prince of Hong Kong

Source: Europa Star October - November 2012 Magazine Issue