Since 2004, the WorldWatchReport™, published by the Digital Luxury Group in partnership with Europa Star, has provided the industry with an exclusive analysis of the interests and preferences of luxury watch consumers around the world. Based on a methodology utilising Digital Luxury Group’s proprietary technology, the report identifies and analyses over 1 billion unbiased spontaneous consumer searches to highlight the forces that drive the luxury watch industry further.

At the occasion of BaselWorld, Digital Luxury Group unveils the results of the 9th edition of the WorldWatchReport™, which tracks online interest expressed through search engines for 62 brands across twenty international markets.

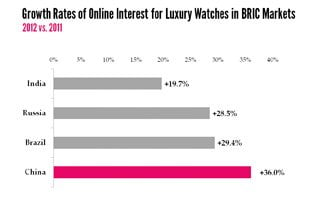

Global interest for luxury watches grew +3.3%, led by BRIC markets (+33.0%) The three largest markets this year were China (25.6% market share), the United States (19.5% market share) and the United Kingdom (8.6% market share). Global demand growth was fuelled by BRIC markets with the highest year-to-year increases in China (+36%), Brazil (+29.4%), Russia (+28.5%) and India (+19.7%). Early signs of demand decline were seen mostly in developed, mature, Western markets. The United States decreasing by -11.6% since last year and Europe by -8.3%.

China consolidates its leadership position with 25.6% of all global searches, growing by +36.0%

China consolidates its leadership position with 25.6% of all global searches, growing by +36.0%

For the second year in a row, China consolidated its leadership position ahead of the United States, with the largest global market share (25.6%) and strongest year-to-year growth (+36.0%). One out of four consumer searches for luxury watches originates from Mainland China. Top three brands this year were: Omega followed by Rolex (up from third place last year), overtaking Longines now at number three. Rolex (+97.8%), Cartier (+71.6%) and Omega (+70.4%) experienced the strongest evolution among the 62 brands analysed.

|

|

Haute Horlogerie (+10.1%) and watch and jewellery (+7.7%) categories growing the fastest

Confirming results observed in the Haute Horlogerie Preview report published at SIHH in January, Haute Horlogerie was the fastest growing category amongst luxury watch clients, showing a healthy growth of +10.1%, followed by the Watch and Jewellery category growing by +7.7%. Both categories had their strongest performance in Asia with 44.2% and 46.8% market share each, followed by Europe (37.5% and 30.7%) and America (18.3% and 22.5%). Exposure to Asia played a crucial role in fuelling categories’ growth: the largest market share in Asia, where the highest growth figures were recorded. In the Haute Horlogerie category, Patek Philippe performed especially well, entering the Top 10 Global ranking for the first time this year and with over 50% of its market share in Asia. Another very strong performer was Vacheron Constantin, which entered the Top 20 Global ranking (19th), and had almost 70% of its market share in Asia. The Watch and Jewellery category was led by Cartier, third in the global ranking (well ahead of other brands in the category), with almost half its market share in Asia and the remainder evenly divided between Europe and America.

Gap between industry leaders Rolex and Omega narrows further

Gap between industry leaders Rolex and Omega narrows further

At constant range over the last five years (25 brands, 10 markets only), the gap between the two leaders narrows further, with a difference in demand of 2.0 percentage points (versus 8.4 in 2009). Rolex continues to lead the Global ranking thanks to number one spots in mostly developed, mature markets (US, India, Europe and the Middle East). Omega’s continuing leadership in large, strongly developing markets (China, Brazil, Russia, Japan, Asia Pacific, Latin America) has helped it slowly but surely gain ground on industry leader, Rolex.

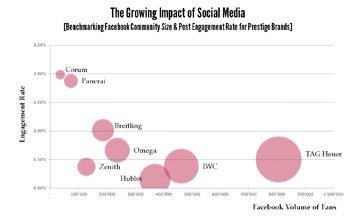

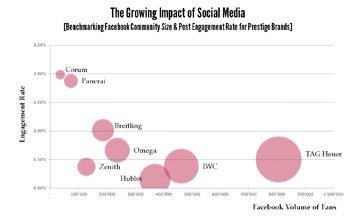

Facebook increasingly influential amongst luxury watch clients: volume growing by +111% and engagement rate by +91%

Facebook increasingly influential amongst luxury watch clients: volume growing by +111% and engagement rate by +91%

By the end of 2012, the 62 brands analyzed regrouped nearly 50 million fans on Facebook, growing by 111% versus last year. The most successful brands per category were: Louis Vuitton (Couture) with 12,170,512 fans, Tiffany & Co. (Watch and Jewellery) with 3,513,922 fans, Tag Heuer (Prestige) with 805,731 fans, Montblanc (High Range) with 374,729 fans and Audemars Piguet (Haute Horlogerie) with 167,333 fans. Brands are getting better at creating interactions with fans, although engagement rate is still low, it is growing, having increased by 91% (from 0.49% in 2011 to 0.94% in 2012).

For more information about the WorldWatchReport™, published by Digital Luxury Group in partnership with Europa Star on an annual basis, please visit www.worldwatchreport.com.

Brands* analyzed in the WorldWatchReport™

*Brands added to the report for the first time are highlighted

Source: Europa Star April - May 2013 magazine issue