At the Annual General Meeting of Compagnie Financière Richemont SA held today in

Geneva, the shareholders approved the results for the year, including the proposals of the board of directors for the appropriation of retained earnings at 31 March 2005.

A dividend of ¤ 0.04 per Richemont unit will be paid to unitholders on the share capital of Compagnie Financière Richemont SA. The dividend will be payable on 19 September 2005 against presentation of coupon number 5, free of charges but subject to Swiss withholding tax at 35 per cent. This represents a total dividend payable of ¤ 22, 968, 000. The Swiss franc equivalent of this amount, calculated at the exchange rate prevailing as at the time of the Annual General Meeting, is Sfr 35, 474, 076. The remaining available retained earnings of the Company at 31 March 2005, after payment of the dividend, will be carried forward.

In addition, a dividend of ¤ 0.96 will be paid by Richemont SA, Luxembourg, a whollyowned subsidiary of Compagnie Financière Richemont SA. This consists of an ordinary dividend of ¤ 0.46 and a special dividend of ¤ 0.50 per unit and will be payable without deduction of withholding taxes or charges, on 19 September 2005, against presentation of coupon number 4.

The total dividend for the year, payable by both entities, will therefore be ¤ 1.00, before deduction of withholding tax.

The shareholders of Compagnie Financière Richemont SA re-elected the serving members of the board of directors and, in addition, appointed Mr Norbert Platt, Group Chief Executive Officer, and Ms Martha Wikstrom to the Board.

Richemont Annual General Meeting 2005 : Trading Statement

At the meeting, Executive Chairman, Mr Johann Rupert, made the following statement in respect of Richemont’s current trading performance:

The benefits of our Maisons’ product development and marketing strategies, linked to

favourable trading conditions in our major markets, have resulted in good growth in sales.The positive trends that we saw last year have continued into the initial months of the current financial year.

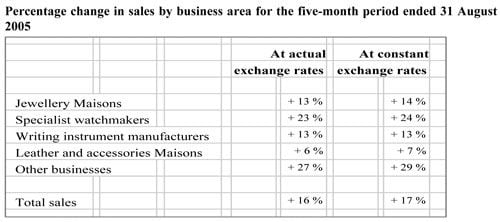

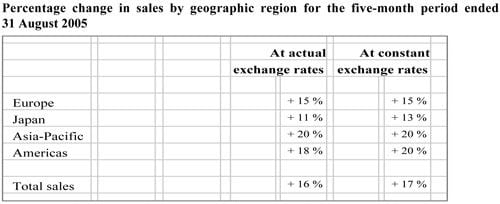

Overall, sales in the five-month period to the end of August showed growth of 16 per cent at actual exchange rates in comparison to the prior year. We have seen good performances in all business areas and across all geographic zones.

Our jewellery businesses, Cartier and Van Cleef & Arpels, have reported growth of 13 per cent at actual exchange rates over the five-month period. Both have benefited considerably from new product lines. Cartier’s new watch ranges – for example the ‘Tankissime’ and ‘Pasha 42’ models – are selling well, whilst - in jewellery - the ‘Panther’ yellow gold and the‘Baby Love’ lines have also been successful.

Sales by the Group’s specialist watchmakers have grown by 23 per cent during the period to end-August. All of the watch businesses have performed well, their new model ranges finding favour in the market.

Equally, Montblanc and Montegrappa sales have also increased at double-digit rates, benefiting from new product launches and strong retail growth.

In our leather and accessories businesses, Lancel is showing signs of recovery with good sales growth. However, Alfred Dunhill has reported a more modest increase during the period, despite a continuing strong performance in Asia Pacific and increased demand in theUnited States. We still have work to do with these businesses to bring their performance into line with their peers in the Group.

Chloé, on the other hand, is performing exceptionally well, driving growth in sales in the ‘other products’ segment.

I indicated that all geographical areas had reported good growth over the period. The strongest growth has come in the Asia-Pacific market and in the United States, with growth of 20 per cent and 18 per cent, respectively, at actual exchange rates. However, we have also seen double-digit growth in Japan and in our home market, Europe.

I would add that Richemont’s investment in British American Tobacco is performing very well. BAT’s adjusted earnings per share for the first half of its financial year increased by 23 per cent and Richemont will receive dividends of almost £ 170 million from BAT during the current year.

Looking forward to the rest of the year is, as always, difficult and I dislike making forecasts.

I remain optimistic for the luxury goods market and that optimism is borne out by the high rate of growth in sales that Richemont has seen in recent months. Our specialist watchmakers, in particular, have performed impressively. The increase has reflected the new product launches that we have seen over the last year and the increased sell-in to our retail partners.

However, we face tough targets for the year as a whole, given the Group’s strong performance last year. Although we expect to see continuing growth in all our businesses, the higher comparatives make it less likely that the rate of growth in sales for the full year will necessarily match the high levels that we have experienced over the first five months. That is particularly true for the watch businesses.

The Group is in a sound financial position and continues to produce exciting products, which our customers love. Taking a long-term view, as always, the Board and I have every confidence in the enduring strengths of Richemont’s businesses and on the ability of Mr Platt and the executive team to ensure the Group’s continuing prosperity.

For its financial year ended 31 March 2005, Richemont reported an increase in sales of 10 per cent to ¤ 3 717 million. Operating profit, on a Swiss GAAP basis, amounted to ¤ 505 million, an increase of 71 per cent over the prior year.

Richemont’s interim results for the six-month period to 30 September 2005 will be released on Thursday, 17 November 2005. These interim results will be presented for the first time in accordance with International Financial Reporting Standards (‘IFRS’) rather than Swiss GAAP. As required under IFRS, Richemont’s results for the prior year will be restated in full compliance with the international standards for comparative purposes. Restated, IFRScompatible figures for the financial year ended 31 March 2005 will be released in mid October.

Richemont owns a portfolio of leading international brands including Cartier, Van Cleef & Arpels, Alfred Dunhill, Montblanc and Lancel as well as the prestigious watch manufacturers Jaeger-LeCoultre, Piaget, Baume & Mercier, IWC, Vacheron Constantin, A. Lange & Söhne and Officine Panerai.

In addition to its luxury goods business, Richemont holds an 18.5 per cent interest in British American Tobacco.

Appendix

Richemont Trading Statement, 15 September 2005

Movements at constant exchange rates are calculated translating underlying sales in local currencies into euros in both the current period and the prior year comparative period at the average exchange rates applicable to the financial year ended 31 March 2005.

Source : Compagnie Financière Richemont SA

www.richemont.com