In line with results in previous months, watch exports registered growth of 13.4% in June, totalling 1.6 billion francs. This considerable increase was achieved despite a very unfavourable base effect. In the first half of the year, Swiss watch manufacturers exported the equivalent of 8.3 billion francs, or 14.9% more than in January-June 2007. The annualised variation was above 15% for the eighth consecutive month at +15.8%.

Growth was steady in the first months of the year, with the exception of March, the victim of an unfavourable base effect and three fewer working days. However the variation of the moving average over twelve months has not fallen from peak levels. Asia has become the engine of growth, while more traditional markets have experienced a slowdown.

Products

June was a particularly good month for exports of wristwatches, which saw their value increase by more than the sector average (+14.5%). The number of pieces exported increased sharply compared to June 2007 (+12.0%), thanks mainly to the category of other materials, up by 130,000 units (+32.6%). Most other materials also contributed to the upturn, particularly gold (+25.0%) and bimetallic timepieces (+55.4%).

The first half-year showed a very favourable result for wristwatches. Their value increased by 15.9% to 7.7 billion francs. During this period, Swiss watch manufacturers dispatched 12.6 million timepieces abroad, an increase of 7.1% compared to January-June 2007. After six months, the increase compared to last year is already 830,000 units. The strongest contributions to these gains came from the categories of other materials (+280,000 pieces), other metals (+270,000 pieces) and steel (+170,000 pieces). Representing a far smaller market share, platinum watches recorded the strongest growth with +82.2%.

Wristwatches displayed two different rates of growth according to their price during the first half-year. Products costing more than 3,000 francs (export price) registered an increase approaching 30%, both in value terms and by number of pieces. Below this threshold, timepieces saw their value increase by 2.3% on average, while volumes rose by 6.1%.

Swiss watch manufacturers did not export only watches in the first half-year. During this period, movements valued at 94.4 million francs left Switzerland (+11.0%). With regard to other components, bracelets remained stable at 87.5 million francs (-1.0%). Cases (34.8 million,

+18.0%) and dials (23.7 million, +26.6%) registered a sharp increase. Alarms and other clocks maintained their 2007 level (17.6 million, -0.5%).

Markets

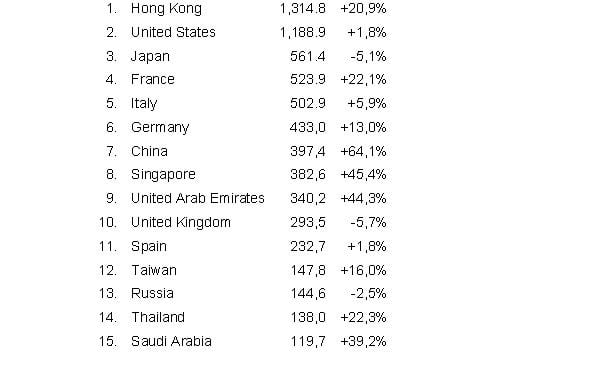

In the first half of 2008, the fifteen main markets showed the following trend (total value in million francs and % variation by comparison with the first half of 2007):

In June, the main destinations for Swiss watchmaking products posted gains. Hong Kong proved very dynamic, while the United States and Japan registered more moderate increases. In Europe, France was aligned with the world average, Italy slowed its rate of growth slightly and Germany recorded a particularly strong increase. In eighth position in June, China doubled its monthly value (+98.8%).

The half-yearly assessment shows growth in excess of 20% for Hong Kong, which has clearly become the leading market for Swiss watch exports since the beginning of the year. The United States continued its slowdown and registered only slight growth between January and June. In third place, Japan saw its situation worsen compared to the first half of 2007. Despite a below average rate of growth, Europe remained an attractive destination for Swiss watch manufacturers with an increase of almost 10%. Winning further market share, exports to China were particularly dynamic. Singapore and the United Arab Emirates also stood out.

Source: Federation of the Swiss Watch Industry FH

www.fhs.ch

Contact:[email protected]