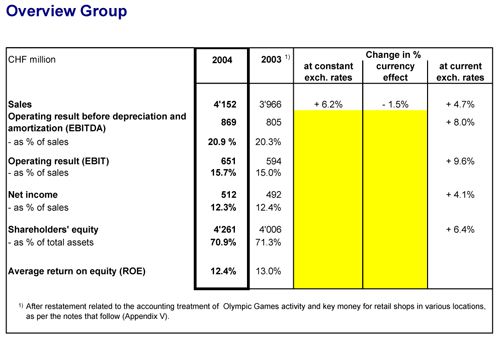

- Marked increase of 9.6% in operating result from 15.0% in previous year to 15.7%

![]() Net income 2004 of CHF 512 million (+ 4.1%) despite adverse currency movements of CHF 33 million

Net income 2004 of CHF 512 million (+ 4.1%) despite adverse currency movements of CHF 33 million

![]() Dividend increase of + 21% i.e., CHF 1.75 (previous year CHF 1.45) per bearer share and CHF 0.35 (previous year CHF 0.29) per registered share

Dividend increase of + 21% i.e., CHF 1.75 (previous year CHF 1.45) per bearer share and CHF 0.35 (previous year CHF 0.29) per registered share

![]() Share buyback program for a volume of CHF 250 million via the second trading line

Share buyback program for a volume of CHF 250 million via the second trading line

![]() Very positive, encouraging start to 2005 with record sales and results for the months of January and February – the highest since the inception of the Group

Very positive, encouraging start to 2005 with record sales and results for the months of January and February – the highest since the inception of the Group

Following the publication of sales figures on February 2, 2005, we now present the consolidated key figures for the Group:

Distribution of profits

At its meeting on March 22, 2005, the Board of Directors proposed a dividend increase of 21% to CHF 1.75 per bearer share (previous year CHF 1.45) and CHF 0.35 per registered share (previous year CHF 0.29) for approval at the annual general meeting on May 18, 2005.

In addition, shares in the amount of CHF 250 million will be bought back via a second trading line.

The exact date for the resumption of the share buyback program will be announced in a separate stock exchange notification.

With these two pro-shareholder moves the Group is clearly demonstrating its intention to repay to shareholders any funds which are surplus to operating requirements.

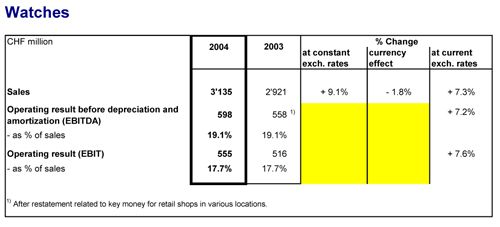

Growth in the Watch segment showed another above-average increase of +9.1% in local currencies and +7.3% in Swiss francs.

The pace of growth in the second half of the year did not quite sustain the performance of the first six months, due particularly to major negative currency effects and a significantly higher comparison base.

Despite the adverse currency impact and marketing investments in connection with the Olympic Games, the Group succeeded in maintaining the operating margin at a high level. This is also related to the above-average growth in the luxury watch segment where margins were highest.

The Group aims to raise the operating margin further, specifically through a continued shift in the product mix towards the luxury goods segment. However, the other watch segments all continue to exhibit sales and earnings potential.

Given the strong presence of the Group and its watch brands in growth markets and the unbroken buoyancy of demand for watches in all segments, the Board of Directors and Executive Group Management Board are very confident for the current year and for the future in general.

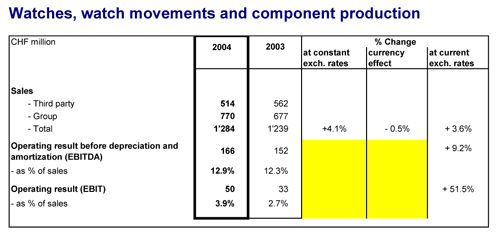

Following the difficult trend in the first half of the year 2004, this segment expected a rebound in the second half, which materialized very impressively.

Both sales and profitability were largely on target in the second half. At 3.9%, the operating margin still has room for improvement, which the Group will seek to drive forward vigorously with further programs to enhance efficiency.

As in the Watch segment, the positive development of the product mix will help to gradually raise productivity on a sustained basis in the watches, watch movements and component production segment as well.

The current level of orders received at the individual production companies looks very promising and a clear improvement in the trend is noticeable.

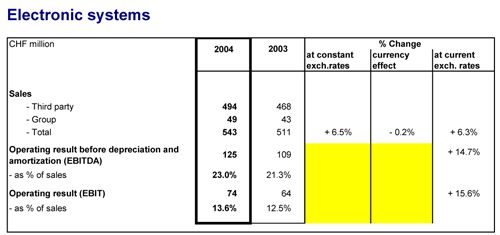

The operating margin increased in 2004, despite a difficult and volatile environment in the semiconductor industry. The rapidly changing cycles in these areas of business will continue to fuel volatility, but the outlook remains optimistic.

Thanks to the niche position held by the products in this segment and the ongoing cost controls and rationalization efforts within the Group it should be possible to continue defending prices against ongoing pressure and achieve further increases in the operating margin.

The strengths of the individual companies in the Electronic Systems segment – such as the miniaturization of products and the reduction of their energy consumption – will continue to generate sales growth in the future as well.

Outlook for 2005

The initial months of the current year have been very successful for the Group. Despite the high comparison base, sales were up noticeably both in local currencies and in Swiss francs, despite a negative currency impact in the tens of millions. January and February of the new year have been absolute record months, with the highest figures for this period of the year since the inception of the Group. In line with the trend in sales, the Group's operating profit and net income for this period were also significantly higher.

The Group’s geographic positioning has also been strengthened, with gains in market share in all regions.

The watch and jewellery show in Basel next week will certainly give an additional, more reliable indication of what we can expect over the rest of the year.

The Group is primed to defend and extend its world market leadership position. This will also entail a further increase in profitability.

The extremely solid state of the Group balance sheet and strong cash flow will enable it to expand and invest further and the dividend increase and resumption of the share buyback program demonstrate very clearly that the Group also attaches great importance to an optimal asset and liability management.

Source:SwatchGroup

www.swatchgroup.com

(Please credit europastar.com)