Breitling, Bulgari, Cartier, Chopard, Ebel, Girard-Perregaux, Jaeger-LeCoultre, Longines, Omega, Patek Philippe, Rolex, Tag Heuer

It covers five of the most important export markets for the luxury watch industry: United States, France, Germany, Italy, United Kingdom.

The team at IC-Agency, consisting of engineers, market–ers and project managers, has developed specific tools to automate the gathering of huge volumes of online search activity data worldwide. This exclusive technology extracts, categorizes and sorts millions of search intentions, which are then combined for relevance and quality-checked before serving as the basis for the World–WatchReport analysis. This year, the report is based upon more than 30 000 000 online searches.

Unless otherwise specified, this year’s report covers the period from January to December 2006, with highlights of the key holiday season from September to December in 2004, 2005 and 2006.

Tailor-made editions of the WorldWatchReport are available from IC-Agency upon request. Single-market and single-brand focus studies, as well as personalized multi-brand comparisons, can be designed according to your unique competitive intelligence and customer insight needs. For more information contact us at:

www.worldwatchreport.com or [email protected]

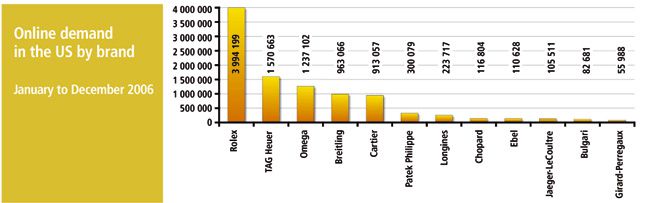

- Rolex is by far the most searched brand, having 254% more searches than its next competitor

![]() The average US to Europe search ratio is 1.92:1

The average US to Europe search ratio is 1.92:1

![]() Tag Heuer and Patek Philippe have higher ratios of 3.89:1 and 3.63, respectively. This is reflected in their increased standings in the US compared to Europe

Tag Heuer and Patek Philippe have higher ratios of 3.89:1 and 3.63, respectively. This is reflected in their increased standings in the US compared to Europe

![]() Chopard also scores better in the US with a ratio of 2.87:1 and taking 8th place

Chopard also scores better in the US with a ratio of 2.87:1 and taking 8th place

![]() The top 5 brands represent 90% of all US searches

The top 5 brands represent 90% of all US searches

![]() Rolex alone represents 41% of all brand searches

Rolex alone represents 41% of all brand searches

![]() Cartier, the number 5 rank, surpasses the next rank, Patek Philippe, by 304%.

Cartier, the number 5 rank, surpasses the next rank, Patek Philippe, by 304%.

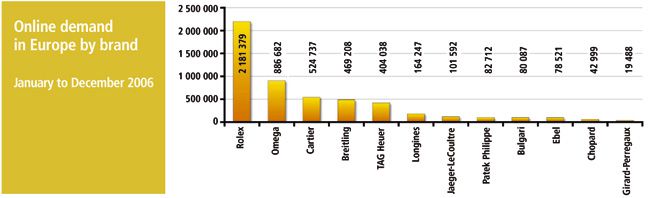

- Rolex is by far the most searched brand, having 246% more searches than its next competitor

![]() Tag Heuer falls to 5th place in Europe, as Omega moves up one rank to number 2 and Cartier up 2 ranks to third place.

Tag Heuer falls to 5th place in Europe, as Omega moves up one rank to number 2 and Cartier up 2 ranks to third place.

![]() The top 5 brands also represent 90% of all European searches

The top 5 brands also represent 90% of all European searches

![]() Rolex alone represents 42% of those searches

Rolex alone represents 42% of those searches

![]() Tag Heuer, the number 5 rank, surpasses the next rank, Longines, by 246%.

Tag Heuer, the number 5 rank, surpasses the next rank, Longines, by 246%.

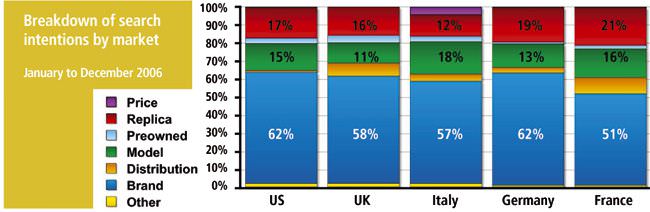

- The majority of searches intentions for all markets are brand-focused

![]() Replica-focused takes an important weighting in all markets this year

Replica-focused takes an important weighting in all markets this year

![]() France and the UK show a relatively important weighting of distribution-focused searches

France and the UK show a relatively important weighting of distribution-focused searches

![]() Italy and the UK show an open mind for the Preowned market

Italy and the UK show an open mind for the Preowned market

![]() Italy is the only market where price-focused searches show a

Italy is the only market where price-focused searches show a

relatively important weighting

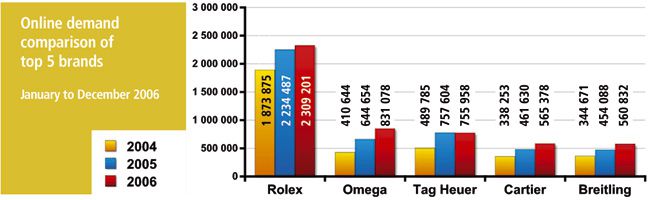

- No new brand entered the top 5, with Rolex maintaining its lead over the second place brand

![]() Omega increased its searches by 19% now taking rank number 2.

Omega increased its searches by 19% now taking rank number 2.

![]() Tag Heuer consequentially fell to third place

Tag Heuer consequentially fell to third place

![]() Cartier increased its searches the most among the top 5 brands with 25%, followed closely by Breitling with 23%.

Cartier increased its searches the most among the top 5 brands with 25%, followed closely by Breitling with 23%.

![]() 37% of searches for Rolex and 38% of searches for Tag

37% of searches for Rolex and 38% of searches for Tag

- The majority of replica related searches come from the US (68.4%)

![]() However, this number is significantly down from last year’s 85.7%

However, this number is significantly down from last year’s 85.7%

![]() France and the UK are responsible for Europe’s increased weighting in replica-focused searches, passing from 0.9% to 6% and 6.2% to 12.8%, respectively.

France and the UK are responsible for Europe’s increased weighting in replica-focused searches, passing from 0.9% to 6% and 6.2% to 12.8%, respectively.

- US, UK and Italy are the top markets in search volume

![]() France has greatly improved its search volume and quality

France has greatly improved its search volume and quality

![]() Rolex dominates all other brands in search volume and quality – Model-specific online marketing is suggested, most notably in Italy and the UK

Rolex dominates all other brands in search volume and quality – Model-specific online marketing is suggested, most notably in Italy and the UK

![]() Tag Heuer is much more searched in the US and UK, needing more awareness in the other European markets

Tag Heuer is much more searched in the US and UK, needing more awareness in the other European markets

![]() Top 5 brands account for 90% of total search volume

Top 5 brands account for 90% of total search volume

![]() Brands not in the top 5 should use offline/online marketing to bring up online demand

Brands not in the top 5 should use offline/online marketing to bring up online demand

![]() Seasonal demand effects the top brands the most. However, it also gives the least searched brands a window of important search volume that can leveraged in a online marketing campaign.

Seasonal demand effects the top brands the most. However, it also gives the least searched brands a window of important search volume that can leveraged in a online marketing campaign.

![]() Italy shines a great country for model-specific searches. France and Italy are distinct from the global results for top searched models, meaning model-specific marketing campaigns could be different from country to country

Italy shines a great country for model-specific searches. France and Italy are distinct from the global results for top searched models, meaning model-specific marketing campaigns could be different from country to country

![]() Replica-focused searches took an important weighting in search intentions this year

Replica-focused searches took an important weighting in search intentions this year

![]() Although the US shows much more search volume and number of Internet users, Retailer-focused searches are more dominant in the UK, and relatively more in France

Although the US shows much more search volume and number of Internet users, Retailer-focused searches are more dominant in the UK, and relatively more in France

For more information and to order a copy of the full WorldWatchReport, visit www.worldwatchreport.com

Source: Europa Star April-May 2007 Magazine Issue