he watch industry is based on recurrence, foreseeability and desirability. Just the opposite of the major upheavals that shape the world – abruptly, immediately, and with frequently unforeseeable causes and consequences. The responses of the states and institutions frequently differ, sometimes converge.

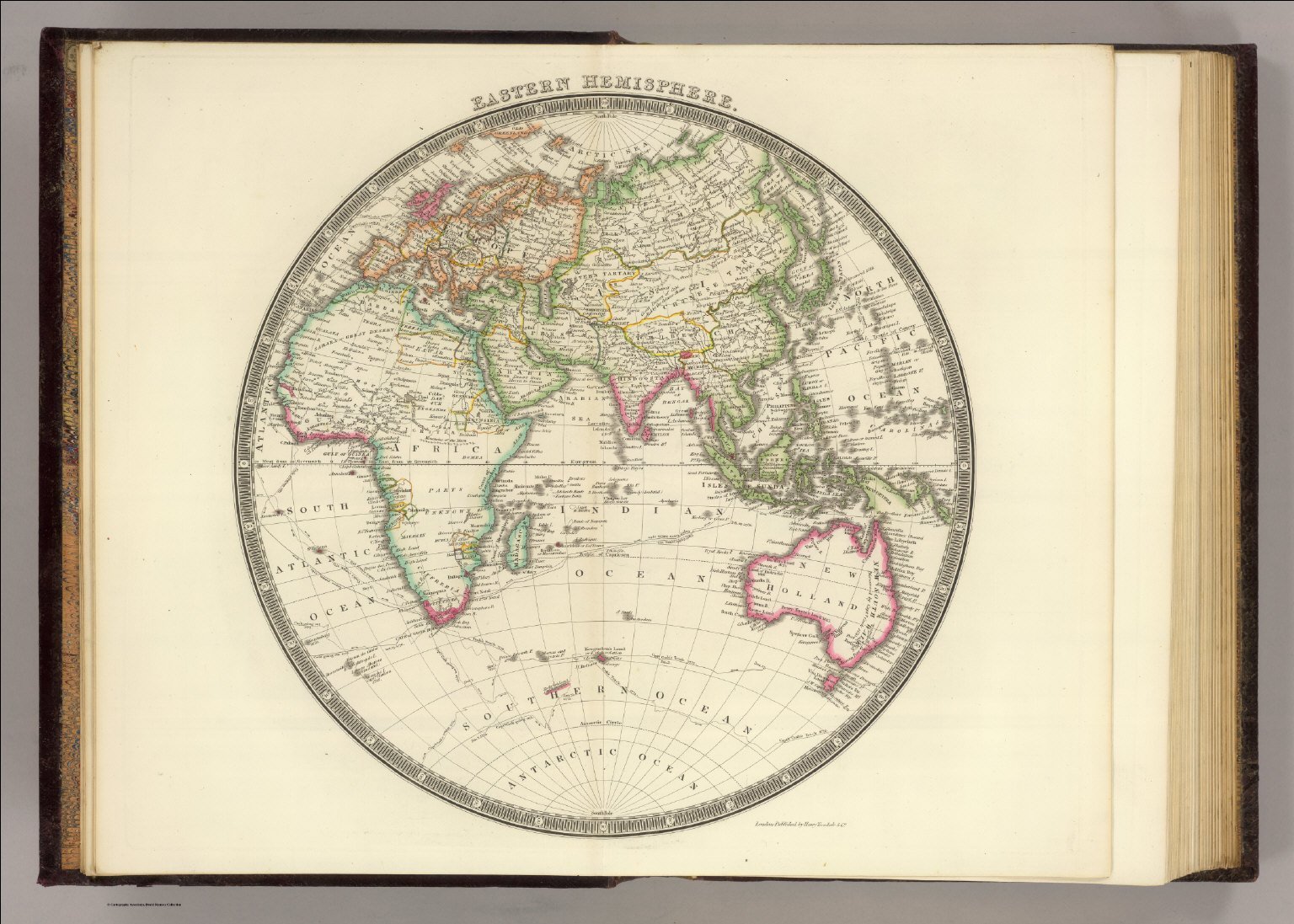

The geopolitical agenda in 2024 is set be one of the busiest of the past few decades. Certain hot spots on the world map have been flashing red for the past months and demand urgent attention. Others are already turning to amber. In 2024, 4.2 billion people will head for the voting booths – half of humanity. 76 countries are concerned, more than one nation in three worldwide, including Mexico, India, Venezuela, Taiwan, Brazil, Pakistan, Bangladesh, Indonesia, Russia, the United States, and the UK, and that’s not counting the European elections. The balance of power will be profoundly altered. What impact will this have on the Swiss watch industry?

Taiwan – China: a crisis with broad ramifications

In such a deeply interconnected world, the consequences of a crisis in Asia could be manifold. Firstly, economic: a power coup by China in Taiwan (which has just elected a pro-independent candidate for the third consecutive time) will profoundly isolate the former on the international scene, with a strong risk of import and export sanctions. But inversely, the effects on Taiwan cannot be ignored either: 90% of the most advanced semiconductors are produced on that island alone. The effects on smartwatch manufacturers, from Apple to Garmin and Samsung, would be immediate. The problem could also affect LVMH (TAG Heuer, Louis Vuitton, Hublot), and that is not even to mention the difficulties the whole of industry would experience in procuring state-of-the-art microtechnology equipment.

War in Ukraine: the delicate matter of Turkey

The outcome of the Russian election (100 million electors) is not really in doubt. Vladimir Putin is a candidate for his own “re-election” for which there is, in reality, no opposition. This being the case, continuation of the war in Ukraine appears equally inevitable. What could change is the balance of power between the blocs that support either one side or the other: the pro-Russian coalition (comprising, for example, China and a certain number of African states) on the one hand and most of the western countries on the other. And first and foremost, the states that navigate to and fro in muddy interstitial waters, among them: Turkey. This is a backdoor for the watch import/export market with Russia and most Central European countries. Turkey also controls access to the Black Sea, through which the bordering countries, such as Georgia and Armenia, can be addressed directly. Erdogan has become a master of the political balancing act, but the day he opts for one side or another, the economic impact on Europe, Switzerland included, will be immediate.

United States: a foregone conclusion?

The American electoral system is such that it is as yet impossible to predict the outcome of the US presidential elections in November. But the line-up of candidates seems certain: Donald Trump versus Joe Biden. Is the result a foregone conclusion? Not really. The former is facing 91 charges in four different criminal procedures. Even so, the American Constitution by no means prohibits an elected president from governing from his cell – an incongruous situation incomprehensible to Europeans. The latter, 81 years old, is posting positive economic results which, strangely enough, are not perceived as such by the Americans (an average 35%-40% believe so). So there is nothing to make his Democratic base feel disposed to vote for him a second time.

What impact will this have on Swiss watchmaking? A major one, because the US market alone accounts for more than 16% of Swiss watch exports. This means that one Swiss watch in every six is sold in the United States. Nevertheless, its growth is already slowing drastically (down 1% in 2023). Traditionally viewed as the counterweight to the Chinese market, for which 2024 is also likely to be a complicated year (the Taiwan situation, latent economic crisis), a post-electoral contraction of the American economy would be extremely damaging for the watch industry.

India: the colossus with feet of clay

In late May, India alone will mobilise half a billion voters. There is little doubt that the election will fall in favour of Mr. Modi. The Indian market is not critical for the Swiss watch industry (22nd position), yet this low ranking belies its vitality: it grew 15% in 2023. If the market share of the US and/or China were to be eroded, watchmakers would have to find other growth markets, and India could be one of them – as long as it experiences no economic meltdown. But its problems are numerous: territorial conflict with China, ethnic and religious tensions, endemic poverty, extreme pressure from climate change. If the Indian economic powerhouse fails, the watch industry will have to find a growth market of similar size.

Mexico could be a likely candidate. For watch exports, its growth rates are very similar (17% in late November). Except that 2024 is an election year for Mexico too, not only presidential, but also parliamentary. But the situation in Mexico is worrying, characterised by insecurity, violence, poverty, labour market reforms and a growing role by the army. A contraction of the Mexican economy would deprive Swiss watchmakers of a market which, admittedly, is not crucial at present, but is lucrative and promising.

Europe: an uncertain future

European elections are scheduled for June. But what is novel, as the 27 head for the voting booths, is that every one of them also faces elections (presidential or parliamentary) at home. This year, therefore, the European political landscape as a whole will change profoundly. Taken separately, these 27 countries contribute little to the Swiss watch economy, but taken as a whole, Europe is market of 450 million consumers. France and Germany alone account for exports worth CHF 2.5 billion. In late November, the Italian market nudged the CHF 1bn mark.

What will be the impact of these elections on Swiss watchmaking? Only moderate. The European economy is driven largely by the French and German economies. In France, inflation is under control, but the weight of the national debt is still crushingly high. President Macron is halfway through his mandate, cannot stand again and so far, various candidates are lining up with no consensus emerging for any particular one. In Germany, the crisis-ridden automotive sector reflects, in reality, the result of a worrying trade balance exacerbated by stagnant demographics and the troubling advance of an extreme right wing encouraged by the breakthroughs already achieved by its counterparts in Austria, Finland, the Netherlands, Italy and Hungary. So for the Swiss watch industry, what lacks in Europe is the most important thing: legibility.

With 27 simultaneous elections, the entire market is going to be turned upside-down. Swiss watchmakers will be forced to adapt to each individual market. In practical terms, the local retailers, who are more firmly established in their respective territories, are probably the brands’ best allies in a context in which building a global European strategy seems impossible. Except, perhaps, for Omega, with the 2024 Olympics in Paris, the economic fallout from which is anticipated to be somewhere between five and ten billion euros.