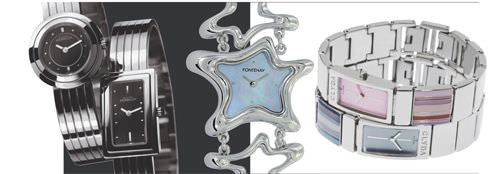

CACHAREL, GUY LAROCHE & CHRISTIAN BERNARD

According to the provisional numbers provided by the French Professional Committee for the Development of Watchmaking, Jewellery and Silverware (CPDHBJO), the timekeeping sector suffered a 4 percent decline in 2005, before taxes, in relation to 2004. As for volume, it fell in all sectors, with the exception of movements and clocks.

The 35 major manufacturers in France produced 300,000 units less than the year before (1.2 million pieces as compared to 1.5 million the previous year). According to Patrice Besnard, there are two major reasons for these dismal results: “The number of watches assembled in France has decreased and the number that has been relocated elsewhere has increased.”

For watches, France is a little like China

The internal market, which leads its own life, without any patriotic considerations, has not really helped the French watch industry, which has seen production decline consistently since 2000. France is a little like China, which lives essentially from exports and sub-contracting. This is the reason that watch products sold abroad (valued at 657 million euros), which also include re-exports, is greater than the internal production (365 million euros, of which 76 million are for watches only). To cite an example in this regard, the Timex company in Besançon is active in both importing and exporting watches.

Europe imports about 400 million watches per year. Exports from French manufacturers (66 percent of turnover, before taxes), without a doubt the most significant number, declined 2 percent in 2005. The reason, most probably, is the “rather morose” European market, says Besnard. “The opportunities for development are in Asia and Latin America,” he adds.

But, fortunately, there are the fashion brands. They have supplanted the traditional brands and have kept the head of French watch sales above water in their own country. For the likes of Cacharel, Louis Féraud, Sonia Rykiel, Morgan, and Guy Laroche, among others, the commercial future looks promising, as it does for the fashion brands held by foreign groups. “Swatch is looking to bring a maximum number of fashion brands into its group,” believes an expert in the watch domain. All the same, it is Switzerland and China that supply the major part of the French market. In 2005, Swiss watches captured two-thirds of the global pie by value, which amounts to a billion euro, while the Chinese grabbed three-quarters of the world’s volume.

MICHEL HEBERLIN, FONTENAY & CLYDA

The importance of the French Touch

If French companies such as TWC, IJD or even Christian Bernard are purposefully betting on the fashion brands and thus occupying the low or lower middle end of the spectrum, there are others, such as Alain Silberstein, Péquignet, Michel Herbelin and Saint-Honoré, which are targeting niche markets in the upper middle and haut de gamme segment. For some, they are doing it using the label, Swiss Made. Today, and even more so tomorrow, being a watch manufacturer in France means being able to innovate, perhaps less so on a technical level than on the overall look. Therefore, the design, or the ‘French Touch’, is very important. The French watch industry is mutating into the category of costume jewellery. Of course, there is the occasional and rather provincial ‘grandmother’ type timepiece, which is one of the specialties of Fontenay, belonging to Christian Bernard. But for the rest, except for a handful of product manufacturers, the watch has become a seasonal accessory, a throwaway or interchangeable item. For this reason, the prices continue to remain reasonable. The growing market is one of ‘chic and cheap’, or, in other words, watches selling for between 100 and 299 euros. Sales in France within this price range (with watches coming from all over the world) increased 9 percent by value last year. This is all well and good, but it does not help the sector. The segment that ordinarily makes the greatest profit is between 300 and 999 euros, but it is actually down 5 percent.

Jewellery drags the watch along, and not the reverse. The jewellery, watchmaking, and gold and silver work in France sectors reported a turnover in 2005 of an estimated 2 billion euros. Watches account for only 365 million euros, so it is clear that the jewellery segment is stronger than watches. This is clearly already the case at Christian Bernard, and is becoming the case at TWC, with a brand such as Clyda, for example.

What is missing is a ‘Swatch Group’ à la française

What the French watch sector is missing is probably an organizational strike force, that would require a grouping of financial means. The French Group of the French Touch does not yet exist. And, perhaps the manufacturers don’t even want one. The example of the Swatch Group is perhaps attractive, even if its brand Swatch seems to be passing through a difficult period, which is, in fact, profiting the American watch group Fossil. According to a watch industry analyst, Fossil has today pulled itself up to the same level that the Swiss Swatch occupied yesterday.

For now, French companies are at risk for takeover by foreign investors, in particular the Asians. Patrice Besnard remembers having been approached last June by a “large Chinese group” that wanted to have information about a French designer, in light of a possible buy-out. The Délégué Général of the CFHM politely received his guests and listened to their questions, but what he was able to tell them was of no help…

One thing that needs to be emphasized in this saga is the extreme dependence of the French watch industry on Switzerland. “In 2005,” according to the CPDHBJO, ‘Switzerland was the primary client of France for watches, as well as for precious jewellery but it was basically a question of transit. The second and third most important clients are Japan and the United States.’ In a few words, the French market is completely dependent upon and indexed to the Swiss market. But, while Switzerland takes a large share of global watch turnover, positioning itself as a milch cow, the quantities of pieces made in that country are decreasing, to the profit of Asia, of course, but also Europe, in general, and France, in particular.

CHARLES JOURDAN, TED LAPIDUS & OXBOW

No to a re-definition of Swiss Made!

As we know, the Federation of the Swiss Watch Industry (FH) has begun a general reflection on the criteria that define ‘Swiss Made’. Manufacturers in Geneva and the Vallée de Joux located in the canton of Vaud, fear that their image will suffer, and so they are pleading for stricter criteria. They would like to expand the notion of ‘country of origin’ that would mean that Swiss Made encompasses the assembly of the movements and the watches. This is precisely what Patrice Besnard, who represents the interests of French watch companies, does not want to hear.

Besnard notes, above all, one thing: “When it comes to the fabrication of bracelets and watch cases, Switzerland is not self-sufficient,” he says covetously. “It needs Asia, but it also needs France, Italy and Germany.” He is not far from saying that the notions of country of origin establishing the term Swiss Made are obsolete. “Other criteria should enter into the discussion,” he adds. “For me, the most important factor is the value of the brand. Rolex is Switzerland. Péquignet and Herbelin are France. The brand is first and foremost. It is the brand that ensures the investment, the design, and the quality.”

Environmental dependencies

The conditions of watch production are another battle horse for Patrice Besnard, and Switzerland is still in his sights. He complains that the suppliers to the Swiss brands are subjected to different environmental standards, depending on whether they are European or Chinese. The respect for the environment in Europe is quite costly for the manufacturers of watch component parts. He cites as an example a site for cleaning watchcases. According to him, the price of a machine that uses the solvent, trichloethylene, can reach 100,000 euros, when it is adapted to make it environmentally friendly. “Just think of a fabricant of watch hands, located in Morteau, in the Franche-Comté region, that has to spend this kind of money, which is not cheap …” he adds. “Asian companies also have cleaning machines that use the same solvent, but their equipment does not have the protective devices to make them safe for the environment, which is one of the reasons for the distortion in prices and competition. It will be necessary for a certain number of brands to position themselves based on their respect for the environmental conditions of production.”

Besnard remembers a visit to Zhuhai, in the Canton region in China, where a Swiss brand [we won’t give the name] sub-contracts the stamping of watch cases. “It was worse than something out of Zola,” he laments. Very attentive to the ecological deontology of Swiss fabricants, the Délégué Général seems to be less vigilant with the Asian habits and customs regarding the French companies. While Tissot sub-contracts a large part of its component parts in China, so do Clyda of the TWC and Christian Bernard and Pierre Lannier sub-contracts in Madagascar. Are you quite sure, Mr. Besnard, that those comapnies observe the rules of hygiene that are required here in Europe? The Délégué Général is not so sure…

But he carries on, and demands that the specifications and requirements be equivalent for all sub-contractors, so that everyone is subject to the same rules. “Failing which,” he explains, “the western consumer, concerned about the environment, should have access to new information, such as the geographic journey that a watch makes during its creation and the conditions of its manufacture.”

This is not all. Patrice Besnard also feels that the standards for water-resistance are too lax. He would like to see a revision of the ISO standard in this domain. “In France, a watch that claims to be water-resistant is resistant to water from the faucet as well as under water in a swimming pool. In Japan, there are various types of water-resistant watches, and they do not meet the same criteria.”

The ‘sino-dollars’

If there are so many questions about Asia and China, it is because the future of French production, as with all watch production, is being orchestrated in the Far East. “The Swatch Group has been in China for twenty years. It is this long-term presence that is saving it,” says Besnard, with admiration, who dreams of having the same type of presence for French manufacturers in the region. “There are more luxury watch consumers in China than in France, and even in the whole of Europe,” he continues pensively. “After the period of oil-dollars, we are now entering into the period of sino-dollars.”

Source: Europa Star April-May 2006 Magazine Issue