The Chinese market evokes reverie among the world’s watchmakers. A few simple statistics makes one understand immediately why. In 2003, China already could count 236,000 millionaires among its population (defined as those whose personal fortunes were greater than US$ 1 million), a number that is up by 12% from the previous year. There were 50,000 inhabitants who had more than US$ 10 million in assets, while 200 of its nationals were worth more than US$ 100 million. It is generally thought that between three and five million consumers could go out “tomorrow morning” and buy luxury products.

What is true for the most luxury-oriented sector of watch production also holds true for the middle and economy segments. With the rapid emergence of a middle class, the appetites for watch consumption are gradually spreading to tens upon tens of millions of Chinese consumers.

Although it is a unified country and still under the iron hand of the current regime, China is a market of contrasts and disparities. What works in Shanghai does not necessarily work in Beijing. It might even work less in Guangzhou, for example, the capital of the Guangdong province, which alone counts some 87 million inhabitants, with an economic growth rate of about 13% per year!

A recent study by the HKTDC (Hong Kong Trade Development Council) helps us to understand these differences between regions. In Shanghai, the average price of a watch is about RMB 2,000, or about ¤ 200, while in Beijing, it is about RMB 500 (¤¤ 50). However, in Guangzhou, the average watch price is around RMB 100, or¤¤ 10. These spectacular variations demonstrate the considerable contrasts in a country of such a colossal size.

To get established in this market is thus not an easy thing. In the Focus that follows, we refrain from all generalizations that might lead to a distorted or unrealistic picture of the situation. However, one observation can be made for those companies desiring a piece of this enormous pie: Patience!

Patience and tenacity seem to be the key words that we hear everywhere. To set up shop in this market and open a nice boutique in one of the shopping malls that are sprouting up all over is one thing, and a very costly thing at that. To really penetrate the market is quite another. To acquire a sufficient reputation and brand image for a long-term implantation is still again something else.

It is therefore quite normal that strategies should differ from one market to another, from one large group to another. The strategies for establishing a brand are dictated by various elements, the most important being the length of time in China. In this respect, the Swatch Group has a good head start, thanks to the fact that it has been in the country for a long time. With the nation opening up economically, the old networks have not disappeared but they have been transformed. Of course, new players have joined the game, but the need to acquire the relationships necessary for making inroads remains the same.

From all points of view, China is a “mixed” country. The liberalization of its economy is not the result of a regime overthrow, but an internal evolution of this regime. Contrary to the Russians, the Chinese began reforming the economy while leaving the political structures in place. A priori, this was more “intelligent” from the point of view of economic development. Since, however, the importance of political networks subsists in China, it is often necessary to develop treasures of patience and diplomacy in order to reach one’s goals.

The recent event organized in Beijing’s Forbidden City by the Richemont group required more than a year of protracted discussions (see Europa Star 5.04). It was only the Swatch Group, thanks to the power of its contacts established long ago, that was able to erect, in Tienanmen Square in the heart of the city, a gigantic watch counting down the hours to “their” Olympic Games in 2008. Omega (the only commercial entity visible on this one-kilometre long space) was thus able to place its logo at the foot of the National Museum of China, where it is photographed by thousands of Chinese tourists every day…

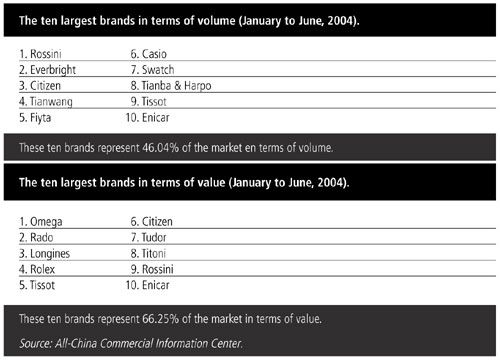

Understanding the numbers in the Chinese watch market

It is extremely difficult and tricky to provide key statistics on the watch market in China in a credible and reliable manner. There are at least two reasons: the uncertainty of the available statistics and the volatility of a situation that is in very rapid transformation. To these two principal reasons, we could also add the various ‘smoke screens’ put up by the brands themselves. In the current market, where all the players want to position themselves quickly and skillfully and where influence peddling in order to get the best spots is legion, ‘disinformation’ is the rule rather than the exception.

It is worth a try, however, to understand, with the usual disclaimers, the principal numbers that can give us a relatively good estimation of this evolving market.

Value of the Chinese watch market

According to widely different sources (Fédération Horlogère Suisse - FH, Shenzen Watch & Clock Association, HKTDC, and the All-China Commercial Information Center), we can estimate that in 2004, the total value, in retail prices, of watches sold in China reached about 8 to 10 billion Rmb, or around 800 million to 1 billion euros. This is, without a doubt, a relatively high estimation.

If we base our numbers on Swiss customs statistics, provided by the FH, Swiss watch exports to China were worth 197.2 million Swiss francs, or nearly 130 million euros, in 2003. If we multiply that by three to get approximate retail prices, we reach a figure of about 600 million Swiss francs or nearly 400 million euros.

According to a number of indications, Swiss watches represent about 70% of the total value of watches sold in China and imported watches account for 80% of all watches sold. If Switzerland accounts for 70%, this leaves 10% for Japanese or other brands, and 20% from China itself. A simple calculation therefore gives us an approximate total of 850 to 900 million Swiss francs, or 550 to 600 million euros, for the total value of the Chinese watch market in 2003.

We also know that Swiss exports to China, which increased 109.3% between 2002 and 2003, were up another 58.7% during the first half of 2004. This means that we can probably expect a total of Swiss exports in the neighbourhood of around 260 million francs by the end of the year, which signifies a total rise of the Chinese market of around 200 million euros in relation to 2003.

Import conditions

Since its entrance into the World Trade Organization in 2002, China lowered its customs duties for watches in 2003 from 23% to 15% and to 11% in 2004. The import quotas that have been on the books until now will be stopped for good in 2005.

In addition to customs duties, there is a value-added tax of 17% on top of the declared value. It quickly becomes very costly, then, to build up a large stock of product in China. And, the rapid changes in market demand, meaning a shorter life cycle, strongly influence how the stock must be managed.

Distribution

The distribution sector in China is also in rapid transformation, following a constantly increasing demand. Today, five watches are sold in the country for every 100 people, in comparison to 25 per 100 in the developed nations, and an average of 12 per 100 inhabitants for the rest of the world.

According to numbers communicated by the Shenzen Watch Association, there are about 2,600 veritable sales points in China. (This does not count stalls and street sales that sell enormous quantities of low-end watches). Among the 2,600 sales points, there are about 200 retailers in the haut de gamme segment, 400 in the mid-range, with the remaining 2,000 in the low-end sector. In 2003, 418 brands vied for space in this market, of which 267 were Chinese brands, meaning that 151 brands were imported. Indicative of the frenzy of the current market situation, this number represents an increase of more than a third in the number of brands entering China over the last three years. This makes it the most dynamic marketplace in the world.

The structure of the distribution system is also in constant evolution, and is mainly based around the mega-urban centres. This system is dominated by the ever-growing shopping malls. These malls vary in size and prestige level and are, along with the department stores, the most highly favoured shopping locations. They seem to be particularly well suited for the mid-range brands. In the luxury domain, on the other hand, most companies have either already established or are now setting up their own boutiques. While these are very important in terms of image, powerful networks of stores specializing in imported quality watches are being built and strengthened (see the Titoni article in this Market Focus).

Only the well-established brands, such as Omega, Rado, Rolex, as well as a few others, can avoid the consignment route. The more recently arrived brands must generally abide by the conditions imposed by various distribution channels. This generally means payment 30 days after the sale, with a deduction of 25% to 30% for the retailer, plus fees of 2% as a rebate to the store’s manager. Another usual practice is that the sales material and window displays are all the responsibility of the brand, as is the personnel who are assigned to sell its products.

Other customary practices include brand participation in special events and other ‘activities’ organized by the sales points during peak selling periods. This participation is mandatory and is set by the sales point and is added to the withholding amount fixed by the contract, and means that it can average around 30% to 35% of turnover.

Given the current explosion of the offer, mainly in the mid-range, the high level of competition means giving rebates to the client. It has become common these days for a customer to demand a reduction of around 20% to 30% off the stated price. During holiday periods, when sales are at their peak, these rebates can easily reach 50%.

Growth in China will depend on consumer products

A recent study by Goldman Sachs fuels the hopes that watchmakers have for the Chinese market. After the efforts in energy, major construction projects and industrialization, the next step in the growth of China’s economy will be based on consumer products.

The economists at Goldman Sachs estimate that the Chinese economy will be the world’s largest by 2035. Consumer products are going to be the base for what they call ‘the second phase of growth’ of the country. One example: Today, China has 16 cars for every 1000 inhabitants, but there will probably be 137 by 2025 and 241 by 2035. To reach these numbers, it is thought that the middle class will double in size. In the emerging ‘BRIC’ countries – Brazil, Russia, India and China - economists estimate that the middle class will number about 800 million by 2035. It is worth noting that this number exceeds the total combined population of the United States, Western Europe and Japan.

The ‘third phase’ of development will be assured, beginning with this date, by the financial markets. The market capitalization of BRIC today represents a modest 3.5% of the world’s total. One can imagine that China and India could very well reach 10% in 20 years, but on one condition - that these countries reform and develop their financial structures.

Illustrations: from Cyril Kobler. “Shanghai recomposé” (Shanghai recomposed) collection created in 2004.

TO BE CONTINUED...

In the forthcoming days, the rest of this lenghty survey will be added to our europastar website.

1. Getting established in China

Understanding the numbers in the Chinese watch market

Growth in China will depend on consumer products

2. Shanghai watch market

3. What the Swatch Group produces in China

Raymond Weil’s penetration of the China market

Roamer: An example in the mid-range

4. Richemont: “Ambassadors of savoir-faire”

5. Philippe Pascal (LVMH): Investing for the long term

6. The lessons - and recommendations - of Titoni

Click here to subscribe to Europa Star Magazine.