t the end of January 2009 in Geneva, the SIHH took place under a rainy, freezing and wintry sky. At the end of March, in BaselWorld; we were again met by the rain, while the sky vacillated between being overcast or letting in a little sun. In both cases, the temperatures remained on the chilly side. Was the weather telling us something about the changing situation in the watch industry? Even though the atmospheric conditions had really nothing to do with it, the general mood corresponded fairly closely to the climatic context. At BaselWorld; there were small signs, however, that led us to believe that spring might be on the horizon.

Right from the start, BaselWorld’s traditional inaugural press conference set the general tone. Beginning with FranÇois ThiÉbaud, CEO of Tissot and President of the Swiss exhibitors group, spoke of “positive signs” in March. He had seen stocks beginning to “dwindle”. But, he also warned, “the Swiss watch industry was undoubtedly going to return to its 2006 export level of CHF 13.7 billion (Euro 9 million) or, at most, to the 2007 level of 16 billion (Euro 2 billion).” The last three years had seen incredible growth rates—10.9 % in 2006, 16.2 % in 2007 and even 6.7 % in 2008.

Obviously, this could not continue forever. The 25 % decline expected for 2009 could therefore simply be a natural correction. Earlier, Jacques Duchêne, President of the Exhibitors’ Committee, declared that during his 50 years in the watch industry, “I have lived through a number of economic crises and we have always come out of them.” Yet, he also warned, “our attitudes and behaviour must change… Nothing will be the same as in the past and we will have to return to more traditional values.” What did he mean by that exactly? One of the knowledgeable watch journalists present at the conference, Timothy Treffry, asked Duchêne to clarify his statement: “You speak of traditional values, but isn’t this the same talk we have heard for years? Isn’t this what all the brands up to now were calling ‘tradition’ when it really was not?”

What was not openly said during this ceremony of atonement, but remained ‘understood’, was that watchmakers, all watchmakers, had happily helped expand the bubble. And now that it has exploded—and not only because of ‘irresponsible bankers’ because everyone was ‘irresponsible’ in their own way—it means the industry has to urgently return to a little more humility. Stop the hollow words and offer more content. Were we going to see this new humility during the following days at the show?

WISeKey by Hublot

Watches find a price

One of the first tangible signs of this ‘new attitude’ was immediately perceptible: watches had again found a ‘price’. During the previous years, it was unseemly to ask the price of a watch—after all how was price important? This year, though, attitudes did an about-face. The price was systematically given at all the stands, even before you could ask about it. This was the first ‘return to tradition’. There was less arrogance and less extravagance, not only stylistically speaking but also from a price point. In this current crisis, every company must justify its prices, which generally have come down. Of course, it was still possible, during strolls around BaselWorld, to find watches, or should we say mechanical machines, whose prices were through the roof. But, with the exception of a few outstanding pieces (Read The collective laboratories in this issue), moderation prevailed pretty much everywhere.

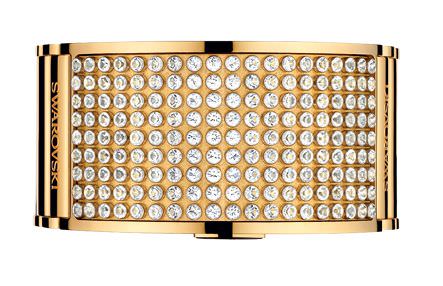

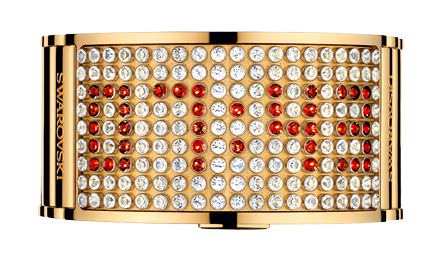

And, as if to affirm the general tone of the fair, the first press presentation after the large inaugural conference was given by Swarovski, which introduced its first watch. Last year, people would have looked askance at this newcomer to the world of watches, but this year there were no signs of condescension. It seemed that Swarovski, with the main part of its offer positioned between Euro 400 and 700, was emblematic of a ‘new’ luxury, a luxury that was quite simply affordable, a luxury that was in phase with today’s economic context. Even more interesting, the pieces were stylistically strong and very captivating, not to mention that the brand’s stand had nothing to envy of the most prestigious brands. It was basically a wall made of 16,000 facets that changed into 40 different animations. Ironically, BaselWorld 2009 began not under the sign of a diamond, but rather under the sign of a crystal.

DLIGHT GOLD OFF-ON by Swarovski

Fake watches are for fake people!

In no particular order

At the same time, at Hublot, Jean-Claude Biver—who, during last year’s period of extravagance, had presented his full diamond Million Dollar BB—was focusing on another issue, more in tune with the times: the fight against counterfeiting. In collaboration with WISeKey, a leader in cryptology, Hublot developed an original technique that Biver claimed as “one of the most ingenious for fighting counterfeiting”.

Basically, it involves giving each watch an identity card with a unique encrypted number. The day of the sale, the retailer puts this number into a reader connected to the Internet. The watch is thus identified and its guarantee takes effect. At each step of the after-sales service or resale, the card verifies the authenticity of the watch and can trace its history. It becomes the timepiece’s passport. While this technology can guarantee the authenticity of the watch to its owner, it also offers great benefits to the brand, a fact not lost on Jean-Claude Biver. The WISeKey also lets the brand carefully control the sell-through and gives it the ability to flush out products on the grey market.

For now, this is the only initiative of this kind, but it shows that watchmakers are not all unified on this point. There is so much confusion about how to fight counterfeiting that it is difficult to understand why the management of BaselWorld and the Exhibitors’ Committee refused to let Jean-Daniel Pasche officially present the campaign, ‘Fakes watches are for fake people!’ Pasche is also President of the Federation of the Swiss Watch Industry (FH), an organization that supposedly represents all Swiss brands.

This refusal was undoubtedly due to the fact that the campaign was conceived and initiated by the FH in partnership with the FHH, the Fondation pour la Haute Horlogerie, guilty as well of organizing the rival salon SIHH. Yet, knowing that the FHH includes 29 brands, of which 13 exhibit at the SIHH, 12 are at BaselWorld and four organize their own show, one cannot help but feel that we are witnessing children fighting over a toy in the school playground. The fight against counterfeiting requires that everyone work together for a common cause and not give in to petty squabbles over territory. It is also true that several horological heavyweights, among them Patek Philippe, Rolex and Breguet, are not part of the FHH. Maybe the fact that the FHH is headed by Franco Cologni, the ex-grey eminence of Richemont makes them consider the FHH to still be tainted by the colours of the rival group.

Philippe Stern and his son Thierry

Poinçon Patek Philippe

Ref. 5960 by Patek Philippe

Hallmark against hallmark

This propensity to go it alone was illustrated, in another domain, by the announcement that Patek Philippe would create its own hallmark. Up to now, the Geneva brand has been perceived as the herald, the ambassador and the greatest promoter of the famous hallmark, the Poinçon de Genève or Geneva Seal, established in 1886. Patek Philippe’s mechanical watches all bore this hallmark, signifying that the demanding criteria of the movements were met and that the piece was assembled in Geneva.

One of the hallmark’s limitations, however, is that it applies only to the movement and that the criteria for finishing are essentially aesthetic. It ignores the case, the functionality and the chronometric specifications, as well as a number of current or future technical developments, such as the use of silicon for some components. Patek Philippe was one of the recent pioneers in experimenting with silicon and thus it began flirting with the limitations imposed by the venerable but 123-year old Poinçon de Genève.

The brand thus came up with a new quality standard for its mechanical watches, which it calls the ‘Poinçon Patek Philippe’. The requirements are much greater than the former hallmark and involve the quality of the movements as much as the case, as well as specifications for the watch’s precision (-3; +2 seconds per 24-hour period for calibres whose diameter is equal or larger than 20mm and -5; +4 seconds for calibres smaller than 20mm) once the timepiece has been placed into its case, which is not the case for the COSC).

This new mark of global quality, which will be controlled by an internal oversight committee and commission, is also a way of reaffirming the independence of the Geneva company, desirous of “deciding its own future in an autonomous manner, without external pressure”.

The announcement of the new hallmark was made at a strategic time, as the impending power transfer from Philippe Stern to his son Thierry is drawing closer. For the first time, during the promotional campaign for the Poinçon Patek Philippe, we saw the two men together in the same photo and looking in the same direction. It also comes at a time when another powerful watch player, Cartier, is proposing its first movements signed with the Poinçon de Genève and made in the ateliers of Roger Dubuis, also part of the Richemont group. This coincidence—which had not been anticipated because the development of this new hallmark took several years—will undoubtedly cause a bit of concern with informed consumers. Why? Patek Philippe’s withdrawal from the Geneva Seal, even if the brand defends it, will maybe devalue its importance.

Oyster Perpetual Datejust II Reselor by Rolex

Datejust Rolesor by Rolex

Hydro 1200 by Tudor

Tidying up

The announcement of this new qualityoriented hallmark comes right during the current economic slump. Today, there is a strong demand for what many people are calling ‘economically correct’. Patek Philippe, for example, its new hallmark aside, is not presenting exceptional new models but is rather revisiting its current collections (see the Cover Story of our previous issue). Most of the major players in the watch sector are acting in a similar manner.

The general mood is thus one of tidying up the collections, of adding new dials or refining the case. Take Rolex, for example. As a final concession to the bling era, the Geneva brand is presenting a ‘Royal Pink’ Oyster Datejust with a striped dial and a strap that mixes rubber, galuchat and diamonds. But the essential is elsewhere. The new Oyster Perpetual Datejust II Rolesor is equipped with a new 41mm movement featuring a parachrome balance spring, permitting a larger date. The timepiece also has slate dials in white, black or grey with striking green Roman numerals. In the ladies’ version, the same Oyster comes with lovely floral motifs on a background of bronze, green, pink or yellow, encircled by a diamond set bezel.

Another sign of the times, Rolex is pushing its second brand, Tudor, with ‘very aggressive’ pricing. Entirely revamped, Tudor’s watches are highly sporty, playing on the design codes of the car world—with a Grantour that celebrates the partnership with Porsche (Tudor is the official timer of the Porsche Motorsport)—as well as the water world, with its Hydro 1200 (water resistant to 1,200 metres, with a helium valve) and its powerful Hydronaut II Chrono. The movements are large-sized ‘Tudorized’ ETA calibres, with an overall black look and rubber straps. Designed for a younger clientele, prices of the new Tudor line range from CHF 2,000 to 4,400 (Euro 1,300 – 2,900).

This is part one of a two part series

Source: Europa Star June-July 2009 Magazine Issue