Richemont, the Swiss luxury goods group, announces its unaudited sales figures for the quarter ended 31 December 2004.

![]() Sales in the three-months up to 31 December 2004 were 9 per cent above the prior year at actual exchange rates.

Sales in the three-months up to 31 December 2004 were 9 per cent above the prior year at actual exchange rates.

![]() Underlying sales in local currencies grew by 13 per cent, with good growth in all areas, including Japan.

Underlying sales in local currencies grew by 13 per cent, with good growth in all areas, including Japan.

![]() Combined sales of Cartier and Van Cleef & Arpels, Richemont’s Jewellery Maisons, increased by 7 per cent at actual rates and 12 per cent at constant rates; sales by the Group’s specialist watchmakers grew by 10 per cent and 14 per cent at actual rates and constant rates, respectively.

Combined sales of Cartier and Van Cleef & Arpels, Richemont’s Jewellery Maisons, increased by 7 per cent at actual rates and 12 per cent at constant rates; sales by the Group’s specialist watchmakers grew by 10 per cent and 14 per cent at actual rates and constant rates, respectively.

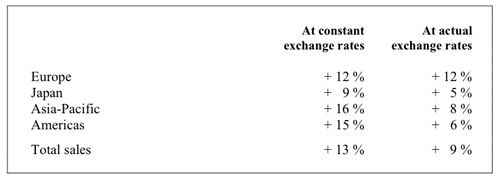

Percentage change in sales by geographic region for the three-month period

In Europe, the signs of a recovery in tourism seen earlier in the year were confirmed, whilst the modest improvement in certain domestic economies continued. Strong growth was seen in sales of jewellery, watches and writing instruments. In the important markets of France and Italy, sales overall increased by 17 per cent and 10 per cent, respectively.

In Japan, there was good underlying sales growth in all business areas although this was offset to some extent by the weakness of the yen. The Group’s Jewellery Maisons, Cartier and Van Cleef & Arpels, saw sales in constant currency terms grow by 7 per cent during the quarter.

Demand in the Asia-Pacific markets remained strong. Sales grew by 8 per cent at actual exchange rates, or some 16 per cent at constant rates, despite the relatively high comparative figures seen in the prior year. Sales in China during the quarter increased by 49 per cent at constant exchange rates, albeit from a low base.

Against strong comparative figures, underlying sales in the Americas continued to show strong growth, although the weakness of the dollar had a significant adverse effect on growth at actual exchange rates. The Group’s Jewellery Maisons reported double-digit growth at constant rates for the quarter, as did Alfred Dunhill.

At actual exchange rates, the Group’s retail sales increased by 9 per cent overall, whilst wholesale sales increased by 8 per cent.

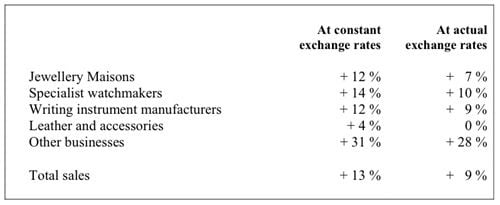

Percentage change in sales by business area for the three-month period

Sales of the Group’s Jewellery Maisons – Cartier and Van Cleef & Arpels – grew by 12 per cent at constant exchange rates, benefiting also from exceptional sales of high jewellery pieces during the quarter. Particularly good growth was seen in the AsiaPacific region, with double-digit increases also seen in Europe and the Americas. Cartier’s new products launched worldwide during the current year, including the Panthère and Trinity jewellery collections, the steel Santos Demoiselle watch and the Santos line of men’s jewellery, contributed to a good performance in the quarter. Gift lines also performed well.

The Group’s specialist watchmakers - Jaeger-LeCoultre, Piaget, IWC, Baume & Mercier, Vacheron Constantin, Officine Panerai and A. Lange & Söhne – continued to enjoy good sales. Particularly strong results were reported by Jaeger-LeCoultre and IWC.

Montblanc reported very good sales growth during the quarter, benefiting from new product launches, including the NightFlight range of leather goods, and the increased level of sales through its own boutique network.

Within leather and accessories, Alfred Dunhill’s continued growth in its key Asian markets as well as in the United States was partially offset by lower sales in Europe. Lancel saw the re-opening of its Paris flagship boutique in September and benefited from the launch of new products.

The “Other businesses” segment includes Chloé, Hackett, Purdey and Old England as well as certain watch component manufacturing activities for third parties. Sales growth in the quarter remained strong particularly for Chloé, which benefited from the expansion of its global retail presence.

In addition to its luxury goods businesses, Richemont holds an 18.8 per cent interest in British American Tobacco.

Press inquiries:

Mr Alan Grieve, Director of Corporate Communications Tel: + 41 22 715 3500

Analysts’ inquiries:

Ms Sophie Cagnard-Fabrici, Head of Investor Relations

Tel: + 33 1 5818 2597