Watch consumers have become more and more skilled at researching information about watches, thanks notably to the Internet. The ability to capture and analyze the millions of pieces of information that pass through search engines allows us to identify—nearly in real time—what consumers are looking for. IC-Agency, publisher of the WorldWatchReport 2009, has conducted an exclusive market study deciphering the Internet searches for luxury timekeepers.

For the fifth edition of the WorldWatchReport, more than 300 million online searches involving 25 luxury watch brands in the seven key export markets were analyzed. Among them were ten of the most prestigious brands: Audemars Piguet, Blancpain, Breguet, Franck Muller, Girard-Perregaux, IWC, Jaeger-LeCoultre, Patek Philippe, Vacheron Constantin and Zenith.

To better understand searches on the Internet, we are offering—exclusively for the readers of Europa Star—a look at the most notable trends from this study as they relate to brands in the haute horlogerie sector.

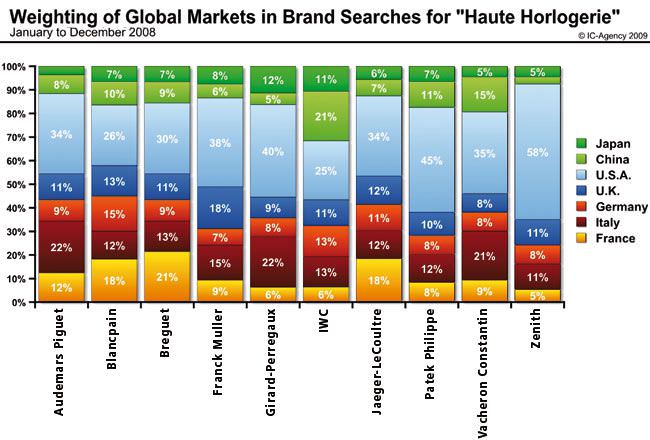

Culture influences how consumers search

First of all, the inclusion of the Chinese and Japanese markets into the study points show disparities that still exist in terms of image and reputation for haute horlogerie brands. In China especially, consumers are principally searching for watch products by brand name without paying any particular attention to specific models or collections. Should we expect to see more marketing based on the product?

Search volumes reflect the brands’ positioning

Once consolidated, the search volume for consumers can be very similar to the relative sell-out numbers according to feedback from industry professionals. This confirms that the online media clearly plays a role during a consumer’s entire experience with the product. Beyond the actual purchase in the store, customers— online at both home and at work—use the web for many reasons before, during and after the sale. They may revisit certain finishings, consult the lists of resellers, or even chat with other owners of the model in order to reassure themselves that they have made the right choice.

Zenith stands out as the brand that most appeals to Anglophone Internet users, capturing 69 percent of these users’ searches in this category, mostly due to the weight of the U.S. market. On a relative basis, it attracts the least share of searches in France (5 percent) compared to other haute horlogerie brands. The Chinese market is still relatively underdeveloped for Zenith.

Patek Philippe is second to Zenith in U.S. searches, but has a much more harmonious spread proportionately across Europe and Asia. Along with Franck Muller, the two brands capture the greatest share of the Anglophone searches (more than 50 percent).

IWC and Girard-Perregaux enjoy a large share of Japanese demand, and have a similar share of searches from France. However IWC is more renowned in Germany and can also boast this 20% weighting in China, way ahead of all the other brands.

Breguet, Blancpain and Jaeger-LeCoultre also capture a similar proportion of French, Italian and English (UK) searches. Jaeger-LeCoultre stands out with the most balanced spread of search share over all the countries analyzed.

Audemars Piguet, Girard-Perregaux and Vacheron Constantin have similar pull from Italy, each boasting about one out of every five searches.

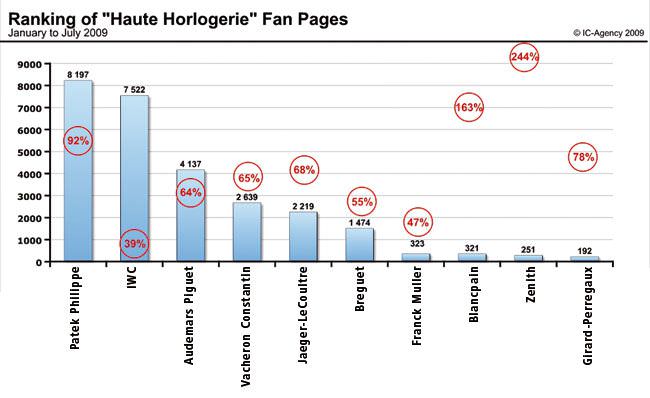

What about social networks?

No less surprising was the study carried out on the presence of brands on social networking sites such as Facebook and YouTube. In fact, this new dimension of the WorldWatchReport provides some very interesting reading for luxury brands concerned about not limiting their exposure to only the official sites. Taking advantage of these types of sites is now possible to reinforce the positioning of a brand’s universe where their current or future clients are spending time. Since we know that there are more than 150,000 self-declared ‘Fans’ of luxury watch brands, do the brands realize the importance of this phenomenon? Let’s take a closer look at the situation.

Generally, the popularity of the Facebook page of an haute horlogerie brand differs dramatically from the volume of online searches they receive. For example Zenith, with the largest share of online searches for its brand name in the category, has only 251 Facebook fans. With growth of 244 percent in just six months, we can expect a continuing increase in the number of fans but will probably not see the levels achieved by Patek Philippe and IWC for quite some time.

The two leading haute horlogerie brands in the Facebook analysis claim more than 7,500 fans each. This is a community comprised of thousands of watch owners and potential consumers eager to receive, consult and share communi-cations published by the Fan Pages Administrator—an aficionado and/or a team working officially for the brand.

Girard-Perregaux is the only exception in this comparison, since it had no Fan Page as of July 22, 2009. Only one Group, which is different from a Fan Page, entitled ‘Girard Perregaux Friends’, has 192 registered subscribers.

On YouTube, haute horlogerie brands do not have the same exposure as on Facebook. For example, only one percent of the videos shown on YouTube for the haute horlogerie category were related to the Patek Philippe brand. On the other hand, Audemars Piguet, which ranked third on Facebook, had 22 percent of the views in first place of the category. Of note are the successful performances of Vacheron Constantin, Girard-Perregaux and Franck Muller in third to fifth place in the ranking of the ‘Most viewed videos of haute horlogerie brands’ on YouTube.

Source: Europa Star August-September 2009 Magazine Issue