In 2008, watch exportation to Asia rose by more than 13%, creating potentially significant business opportunities in this part of the world for the watchmaking industry. China is expected to become the 2nd largest consumer of luxury products by 2015, and its neighbour Japan now has more than 400 million Internet users, that is as many as North America and Europe combined.

![]() How to understand the online behaviour of the watchmaking clientele?

How to understand the online behaviour of the watchmaking clientele?

![]() Do search intentions differ between a Chinese, a European or an American prospect looking for information about a watch brand?

Do search intentions differ between a Chinese, a European or an American prospect looking for information about a watch brand?

![]() How can a brand or a retailer adapt its online communication in these different parts of the world?

How can a brand or a retailer adapt its online communication in these different parts of the world?

To answer these questions, the WorldWatchReport published by IC-Agency and its partner Europa Star deciphers each year the main trends of the online demand coming from prestigious watch brands’ clientele. In 2009, 7 key export markets are included in the scope: China, Japan, the United States, the United Kingdom, France, Germany and Italy.

Compared to last year’s edition which covered 12 prestigious watch brands (Europa Star 2/2008), the scope of the 2009 edition has been extended to cover 30 brands including Audemars Piguet, Vacheron Constantin, Zenith, Hublot, IWC and Officine Panerai.

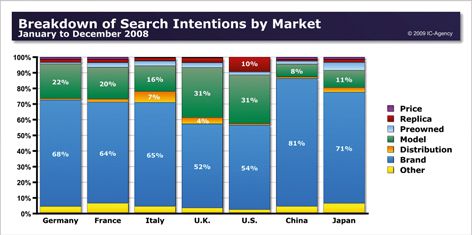

In exclusivity, here is one of the main trends revealed by the 2009 edition: The three biggest markets in the world clearly differ from one another regarding search intentions:

![]() Asia, represented by search volumes coming from China and Japan, presents an astonishing majority of brand-related searches, with 81% in China (see chart) and 71% in Japan.

Asia, represented by search volumes coming from China and Japan, presents an astonishing majority of brand-related searches, with 81% in China (see chart) and 71% in Japan.

As an historically and structurally very specific market, Japan strongly distinguishes itself from China, regarding the proportion of searches related to ‘Distribution’ for instance (3%).

Very close from the purchasing act, searches done by Japanese prospects reflect a strong Internet penetration as well as a mature watch market. With 70% of Japanese people connected to the Internet and the highest concentration of luxury stores in the world, the amount of queries related to Distribution comes from Japanese people’s strong propensity to evaluate their future purchases and gather information about points of sale, on- or off-line.

Another signal suggesting that e-commerce might be worth the effort in Japan, as it was for Cartier and its relatively successful e-commerce launch in this country.

![]() Anglo-Saxon countries (United Kingdom and United States) show the highest proportion of model-related queries: 31% in both countries.

Anglo-Saxon countries (United Kingdom and United States) show the highest proportion of model-related queries: 31% in both countries.

American and British prospects clearly have a better, more in-depth knowledge of the watches offered than their European or Asian counterparts: they appear as the most knowledgeable throughout the entire analysis.

Are the names of the model, whose majority is in English language, easier to remember? Sign of a mature market, the American and British clientele may be significantly more impacted by communication campaigns based on collection names than people based in France, Germany or Italy. At least, the way they use search engines suggests so.

This expertise from the Anglo-Saxon clientele offers great opportunities to position a website on the most searched for topics related to models and collections in these two countries. A good way to optimize visibility in search engines, attract more visitors and eventually boost sales.

![]() Europe (without the United Kingdom) displays some homogeneity in the search intentions breakdown.

Europe (without the United Kingdom) displays some homogeneity in the search intentions breakdown.

Globally, the similarities between the watch brands’ clientele on-line behaviour strikes more than their differences. Usage of the Internet and the way to make queries in search engines went through a radical evolution to eventually converge in the mature markets that are Europe, the United States and Japan. In the middle of a profound transformation, China remains the only country in which significant changes regarding online behaviour are likely to occur.

Thanks to the WorldWatchReport, watchmakers and retailers now have a source of strategic information to follow the evolution of demand for watches in different parts of the world in order to optimize their digital marketing strategies.

Focus on China: Brand awareness first!

In China, 81% of search intentions are related to a ‘Brand’ intention, the highest percentage of the whole analysis, while only 8% concern specific models, the lowest percentage of the analysis for this category.

How can such a strong interest towards brand names and such a low interest in specific models or collections be explained?

The arrival, less than 15 years ago, of big luxury brands, deeply modified the industry’s landscape in China. Despite a considerable urban and wealthy population, whose luxury goods consumption could represent 60% of international luxury sales (according to China Daily), the Chinese clientele do not seem to have a good knowledge of these products.

This is what their search intentions on the Internet regarding the 30 brands of the analysis tell. The attention given by Chinese consumers to watch brands seems to concern the brand name only, for now.

Despite a growing interest for this industry, Chinese consumers may still find difficulty in distinguishing the specific-ities of the watch offer due to the number of actors on the market: ‘the country’s big spenders are often only aware of the most popular luxury labels’ (Luxury Brands in China, KPMG, 2008).

Due to the awareness-building campaigns led by the main watch brands active in China, the Chinese clientele so far has been mainly exposed to visual elements translating only the names, logos and brand universe in the media or during specific events.

In this context, the question arises of how to support the promotion of the watch making culture, its heritage, its quality and the experience it brings? Isn’t this a strong differentiation potential for brands and retailers whose communication gives more visibility to collections, models and watchmaking know-how?

For more information click on www.worldwatchreport.com