What can they teach us that might also serve the 1% of the industry in whom most of the value is bundled and on whom the spotlights are focused? Below are the lessons of the 99%, who sometimes serve as a laboratory or even as the vanguard of what will (or will not) be adopted by the watchmaking cream.

hey are the ones we tend to ignore. ‘They’ are the cheap watches that make up the 99% of the volume of watches sold worldwide, usually for less than 300 dollars, mainly Chinese-made, often bearing a famous, non-watchmaking brand or an unknown logo, or simply fake...

It’s an opaque, dense, ephemeral world, with innumerable newcomers swelling the ranks while innumerable others are consigned to the graveyard of the watchmaking industry. “They” are the watches bought on impulse at the beach or in a suburban shopping mall, light years away from the relative stability of the 1%, whose smallest acts and gestures are dissected under the microscope of the specialist press. Proof of this is how difficult it was to find contributors to this feature with any knowledge of the prolific world of “high-volume” brands.

First steps to watch ownership...

But take a look at the wrist of your waiter, vet, hairdresser, sister-in-law, or that well-dressed businessman tapping away at his smartphone in the departure lounge of any major airport. Maybe it’s a Daniel Wellington, a Fossil, an Armani, a Hugo Boss, an Esprit, an MVMT – or maybe even an Apple Watch or a Samsung...

These watches are important, not only in terms of volume, but also because they often represent the first step (and sometimes also the last) towards watch ownership for the vast majority of people all over the world; people who are neither fascinated nor obsessed by watches but who buy one out of necessity, for convenience’s sake or simply by chance.

There’s one notable, Swiss, exception in this affordability ball: Swatch (and its little sister, Flik Flak), which has succeeded in maintaining its place at the top of the fashion world in a market which is ephemeral by nature – and over several decades. What are its secrets? We reveal some of them in our portrait in the article: Swatch, constantly breaking the mould. And then there’s Tissot and its four million watches sold every year and, on a more general note, the worthy ambition of the Swatch Group not to cut itself off from its ‘grassroots’ – its industrial origins and the welcome legacy of Nicolas Hayek, which we recounted in great detail in our previous chapter.

...but not a new ‘Proletarian Watch’

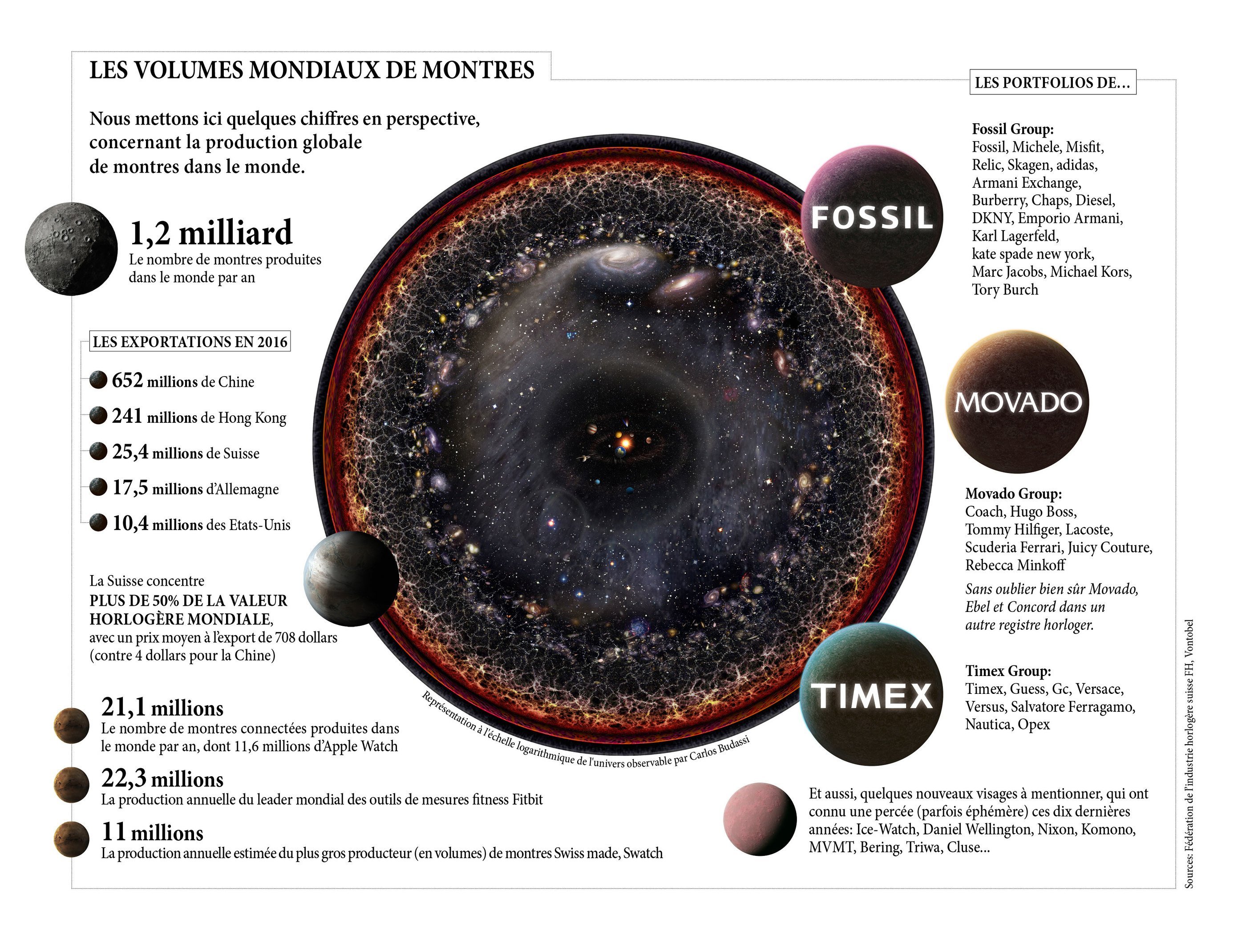

This is not about millions of watches but well over a billion timepieces produced every year (to be precise, 1.2 billion according to the Swiss horology federation (FH); 1.4 billion according to the Japanese horology federation). The unknown Chinese giants will be covered in our next issue. Regular readers will also remember our analysis of the Indian market and its all-powerful local player, Titan (see our previous issue).

The more nostalgic readers among you will also have devoured our last Archives section, which was devoted to Roskopf’s ‘Proletarian’ watch. But it would be inappropriate in these politically correct times to talk of watch ‘proletarians’ in this latest chapter. All the more so since today, lines are becoming blurred and the well-ordered pyramid of values now looks more like an Impressionist painting: the welloff do not necessarily care about buying a valuable watch (an Ice-Watch will sometimes do just as well); and people on only a modest income might well save up for the watch of their dreams (Swiss, of course).

The internet has naturally had a hand in this, triggering a horizontal communications hierarchy – Facebook, the great equaliser – and scrambling codes big time. But the sudden emergence and frenzied dance of these myriad accessible brands is also, paradoxically, affecting the fate of the grand old watchmaking names. Not directly, but by impacting the behaviour of buyers who can be less easily assigned to any specific category.

Renewed interest in entry-level products?

As watchmaking climbed to the high end of the market,

there was a tendency to ignore the more accessible categories

of watch as their total proportional value in the industry

declined. But now we’re seeing a return to democracy, manifested

mainly in lower prices for a considerable number of

middle to upper-range timepieces.

That’s one more reason to look at the lessons to be learned

from the low end of the market, the precursor segment for

certain phenomena which might one day affect the luxury

market. Our non-exhaustive aim here is to learn six lessons

from the emergence of these watches, today fostered among

other things by crowdfunding. Lessons which, we hope, will

benefit everyone.

1. Attacking perceived values

In a world where the correlation between price and perceived value is increasingly blurred we seem to be entering a ‘post-luxury’ era of consumerism, as two articles by Winston Chesterfield and Oliver Williams set out (see the article : How non-luxury is seducing the wealthiest). In the clothes and accessories segments, for example, design has been democratised to the point of debunking the notion that “good design is always costly”, writes the former. This is the wager of innumerable new, cheap watch brands that are being launched on the internet: they are playing the card of contemporary, sober, pared-down and original design rather than simply copying the major brands – in short, whatever the fashion of the moment is – in an attempt to win over a customer base which is actually well able to afford fine watchmaking.

When he declares that “a 200-euro fashion watch has to have a perceived value of 1,000 euros,” Xavier Gauderlot, President for Europe of Movado Group, which produces under licence the brands Hugo Boss, Tommy Hilfiger and Coach that sell by the million, is stating virtually the same thing. Sufficient perceived value, at any rate, to win over customers drawn firstly by a design, a name or a state of mind and who do not stop to reflect on the watchmaking legitimacy of the traditional brands.

On this point, we have to be clear that the interest of the new middle class in tracking down the latest ‘exclusive’ brand seems to have more to do with the originality of a concept than with the price of that concept. By substantially lowering the price of entry-level watches, by allowing new brands to be launched at a reasonable price via crowdfunding or platforms such as Kickstarter, the internet has accelerated the fragmentation of the watchmaking landscape and the scrambling of codes. These brands rarely succeed in making a permanent mark – but their repeated assaults might, one day, have a real effect. And even so, they are already shifting the exclusivity barrier between a small, newly created but well-designed watch brand that produces 5,000 items at 200 dollars each, and an established brand producing more than a million watches costing 2,000 dollars each.

The internet has exponentially increased the number of possible pathways to achieving ’perceived value’ in watches. New brands have benefited from this cut-price entry ticket, as well as from the craze of young buyers for elegant, classic, and ultimately simpler, designs; as for the fashion brands, they have flooded the market with names from the world of luxury at prices far below those of the horological ‘pure players’, thereby scrambling the codes of value even further in the minds of the consumer.

Are these brand usurpers making the most of their fresh approach, in the case of some, or their marketing power, in the case of others, to turn consumers away from more legitimate brands? Might they also help convert young – and otherwise virgin – wrists, ultimately benefiting the entire ecosystem? The tension is palpable between a desire to reject this kind of competition out of hand and that of making a closer, more holistic reading of the market.

As Piers Schmidt underlines in the article : How digital democratised luxury, the internet has been a

game-changer, reducing entry-level prices while raising the

number of products in the marketplace and blurring the

codes of luxury: “In the past just being considered ‘luxury’

was enough to instil trust – that barely spoken promise of

quality and excellence. However, with the democratisation

of luxury, trust of a consumer is no longer a given. We all

want to double then triple-check if something is generally

considered good, enjoyable or reliable by others.”

The lesson to be learned is that at a time when the traditional

brands are simplifying their lines and, very often, reassessing

their entry-level prices, the high-volume brands,

exploiting the democratisation of the codes of luxury and

the proximity to each and every consumer (and their suppliers)

made possible by the web, are reshuffling the cards

of perceived value and posing one heck of a challenge to the

entire industry.

2. ‘Less formality!’: the dictates of fashion

As we saw during the American and French presidential elections – and observing the debates of today and yesterday is fascinating in this respect – formality of language is on the way out, familiarity is in. You see it in marketing, when Ikea addresses every customer, whatever his or her age, gender or respectability, in the same casual way. And the watchmaking world is no exception: how many brands are trying to get closer to their customers, embrace their new codes, reinvent themselves, rejuvenate? After all, luxury is ageless...

One of the best examples of this new, informal spirit and renewed youth is without any doubt Gucci, under the influence of its designer, Alessandro Michele. Gucci is none other than the inventor of the fashion watch and consequently of the convergence of fashion and horology that turned the industry’s landscape upside-down. For the director of its watchmaking division, Piero Braga (read the interview in the article Gucci : "The average age of our customers is falling dramatically), that company, which is present with sassy designs in virtually every range, is the new favourite luxury brand of the famous ‘millennials’ – the same, indefinable millennials who are bringing the whole pyramid of values into question by taking the liberty of combining a Zara T-shirt with a Rolex, or an Armani jacket with a vintage Casio watch.

Casual communications for casual products – unless a brand lays deliberate claim to the codes of formality almost as a distinguishing characteristic. The crucial thing is to distance yourself from three foes: seriousness, synonymous with boring; jumping on the bandwagon, synonymous with boring; and immobility, synonymous with… boring. Rapid turnover of stocks, continuous self-questioning, a never-ending reinvention of image: there are clear signs that virtually the entire watchmaking industry (not just the high-volume brands) has fallen prey to the sirens of fashion – or rather its pace. So much so that today there is a risk of saturation due to the diktat of novelty imposed on an industrial product that, by its very nature, calls for a certain inertia. Moreover, the counter-revolution is under way, with the traditional brands starting to cut back on the number of items they offer – just the opposite of what the high-volume brands are doing.

Because the corollary to this quest for fashion is the requirement to always come up with something new. That is the risk when you try to ‘fashionise’ an industry that otherwise promotes the timeless value and durability of its products. It is a dilemma from which only the brands which defend their values most intransigently will emerge unscathed! Because we know the limitations of throwaway consumerism, which is ephemeral and insatiable at the same time – and in which very often, paradoxically, everything ends up looking the same (for more on this, read the comments by the boss of Zeon Watches in the article Fashion Watches: The Apple effect)!

“Fashion means understanding new trends very fast,” says Fabrizio Buonamassa, who heads up watch design at Bulgari. “But it’s also changing and renewing yourself all the time. Now that is not luxury. The challenge facing us is to find new forms of joie de vivre, to understand the world’s changing aspirations, without succumbing to hysteria.” The most difficult exercise has to be understanding the new customers: “The paradox of young people is that they are growing up in a globalised world while looking for something unique. Today, the spirit of luxury has to be more about laughing and having fun for some segments of our clientele. We’ve got nothing left to prove, and that’s why we can play around with the brand.”

UThat means that the most legitimate brands are the best equipped to change codes and trends in a lasting way, for example by integrating innovations from players from outside the field. But they are also the ones who need to avoid falling prey to the language of facility and using informality as a purely marketing gimmick; they have to keep the greatest distance between themselves and these new trends. A new, less formal and more accessible kind of luxury (accessible in spirit, not necessarily price) has been emerging in the past few years. The success of a brand like Hublot, which is continuously integrating new materials and communicating in a whole new way is largely due to that; it transposes the codes of fashion into watchmaking. For the more traditional brands on the other hand, one of the keys consists in getting a rapid grasp of new trends – without succumbing to them!

3. The ‘S**** word’ – Swiss-made: from legitimacy to uncertainty

People do not generally associate high-volume brands with ‘Swiss-made’, the latter being reserved for the horological elite. Except that the recent debate about the label, which resulted in a toughening of the legislation (a reform considered insufficient by some, too restrictive by others), was largely triggered by an influx of brands that succeeded in obtaining it at little cost during the golden decade of the early 2000s. Added to this is the issue of counterfeit goods, another favourite topic of the FH and a huge generator of volume, which allowed those who could not afford the famous label to at least buy an imitation.

The ‘Swiss’ brand was bandied about, losing its lustre and its legitimacy in the process, due not only to very permissive legislation but also to pirating pure and simple, as well as to wannabe watches that looked very similar to Swiss models and labelled ‘Swiss origin’ or ‘Swiss movement’. The codes dorn a maximum number of wrists. Boasting Swiss origins by any means was the order of the day.

So much so that today the legitimate Swiss industry is faced with a dilemma: should it or should it not bear this once glorious title? Will the new law alone suffice to reassure consumers? And do they actually care? Because the internet era is also one of paradox: on the one hand, the web has helped scramble the codes of luxury, thereby adding to the confusion about what it means to be an elite label, while on the other hand, the glut of information it has spawned is engendering calls for greater transparency and product traceability.

Many brands launched through crowdfunding state their intention to ‘let their community share’ in the creation and success of their watches – a process which should logically unfold transparently; yet they are careful not to mention the origins or means of productions of their innovative products. They tell us everything about the design, nothing about the origins! This – the ambiguous requirement of transparency which is so keenly reflected in the debate on the ‘Swiss-made’ label – is the challenge facing the traditional brands. Many of them have been pirated: in that case, can they afford to display a label that allowed so much excess, so much misrepresentation? And not only the label, the language itself is being called into question: words like ‘DNA’, ‘codes’ or ‘legacy’ are today used so frequently in the marketing of any watch brand that you might well ask if they still have any meaning. If they are squandered like that for the purposes of ‘storytelling’, would it not be better to ban them altogether?

Since fashion took over the tools and linguistic elements of luxury, luxury itself has been forced to evolve. Søren Petersen, CEO of the high-end watch brand Urban Jürgensen, believes that we are at a turning point where luxury is concerned, and rails against the kind of baseless storytelling that is so rife: “We’re entering the age of transparency! Paradoxically, this new era will bring us back to sound values.” He feels that behind the plethora of overblown discourse, potted histories, inconsistencies and pseudo-marketing, a purification of the definition of luxury watchmaking is already under way. According to the entrepreneur, the salvation of ‘true luxury’ lies in artisanal production, patience and limited output: “I have no doubts about the survival of historically authentic brands based on artisanal know-how who take the time to perfect their costly choice of skills.”

The sole value of a true luxury brand, its name, should suffice to legitimise it regardless of any other label: “I like the attitude of Rolls-Royce. When you see their 15-minute YouTube video the first thing they show is that the aluminium chassis arrives from Germany! So what? It’s a Rolls-Royce. It is highly likely the best aluminium chassis in the world. It is confidence in the brand itself that counts.”

In other words, authenticity when the label which is meant to define it has been overused. Another overused word, but we’ll let it pass!

4. The importance of the strap

Let’s take a detour outside the dial. With the explosion of watch offerings in the past 15 years, just about everything there is to be said and done has been said and done with regard to watch cases; consequently many high-volume brands are focusing on another aspect: the strap. Easily interchangeable to create several looks for the same watch, in NATOstyle nylon, Milanese mesh or rubber, they have made brands like Daniel Wellington a hit with younger buyers. Changing the strap rather than changing the watch – that’s a concept that satisfies the younger consumers’ hankering for something new while saving money at the same time. Also, they prefer not to go to a retailer to change the strap of a watch they ordered online.

Luxury watches too have moved massively into this new playing field. At the last Baselworld, the choice of wrist straps had grown exponentially and it is now increasingly easy to personalise straps online (see our article Internet - Digital bespoke of Time.Keeper). And today it is no longer surprising to see a denim strap on a model costing several tens of thousands of Swiss francs – much to the dismay of purists who demand durability not only inside the watch but also outside it!

As for smartwatches, it’s worth mentioning that Apple has never produced so many versions of any product as of its Watch: multiple straps mean multiple accessories and even more potential profits. TAG Heuer rounds out this concept by making the strap a central element of its Connected Modular, the smart (or ‘eternal’, to quote Jean-Claude Biver) case of which is interchangeable. Ultimately, both the strap and the case are modular, maximising choice for those who hate choosing or are simply unable to choose!

Interchangeable wrist straps is a theme which is likely to gain importance. It also demonstrates how high-volume brands, whether smart or not, can influence the habits of the younger customer, whose new expectations end up instilling new practices in an entire industry...

5. Obsolescence – a new branch in the watchmaking tree

So what is the place of smartwatches in all this? We have not seen the sudden flood of products predicted by some, nor the total flop announced by others. Nevertheless, the digital ambitions of giants such as the Fossil Group suggest that numerous developments lie ahead for this embryonic market.

In a nutshell, it is not a new tree in itself, but a new branch in the tree of horology – and one that is already exercising a strong influence on the fashion brands, which are the most strongly affected by this competition (for more on this read the very detailed analysis by Joe Thompson in the article Fashion watches: The Apple effect). During his presentation of Apple Watch 2, Tim Cook, the boss of the California-based giant, tried to legitimise their watchmaking pedigree by citing a study by Vontobel bank, which places his brand as the world number two in the sector (see the article: The winners are independent high-end brands). Although the sales volumes – which Apple did not reveal – are no doubt disappointing compared with the surge in sales of iPhones or iPads, they are high in relation to the size of the industry.

Although smartwatches are still in their infancy – tribute is due here to the Swatch Group for its pioneering spirit, with its Paparazzi and Access watches – and restricted to entry-level and high-volume brands, the epidemic, albeit taking a tortuous path, is beginning to spread. Take Montblanc, itself an outsider,which with its new Summit watch has incorporated non-watchmaking technology into the world of luxury watches. Think out of the box! you might legitimately say in its case. So will the vast majority of watches in the future be smartwatches? Possibly. Will they comprise at least one smart module? Probably. According to René Weber of Vontobel bank, one-third of quartz watches will have a movement equipped with a chip within five years. A vast reconfiguration is taking place affecting first of all regions outside Switzerland (the famous 1.2 billion watches produced worldwide).

But while the entry-level and middle ranges seem to be on the fast track to connectivity, handcrafted luxury watches might well be able to do without it!

6. E-commerce laboratories

“The watchmaking industry set up a strict system for controlling its distribution decades ago. But the internet is causing massive leakage from distribution channels, which is affecting everybody. Today, the World Wide Web is more like the Wild West – the ecosystem is still in the making.” Aletta Stas, of Frederique Constant, could not have summed the situation up more succinctly.

The digital revolution may eventually result in smartwatch supremacy. But online sales are happening now. And so the luxury brands are faced with a number of thorny questions: how to sell online without denting your image? How to reproduce the experience of a luxury boutique on the web? How to handle the logistics of such a total upheaval? In this configuration, what will be the new profit margin? Who will control customer data? Where can we find the right partners for a successful transition? The potential list of questions is long. The more affordable brands are a laboratory that is already providing some answers, because they have had to adjust to their customers’ new purchasing habits for a number of years. The latter will not necessarily travel to purchase a product that costs no more than the shoes that they already buy online....

Some have the ‘technological’ advantage of having been born on the web and the social media and of using only them for promotion purposes and, consequently, for sales. No need to transform their whole commercial set-up. Others make full use of all channels and distribute as much through retailers ‘abandoned’ by the traditional brands as over the internet. The retailers too, it has to be said, are also seriously turning to online sales – although this is far from being the promised panacea!

There are multiple channels ranging from direct sales from an e-boutique and those of specialist partners right through to giant platforms like Amazon. For luxury brands, their conquest of the web could be achieved by first of all analysing a few case studies of the brands operating in the under- 500-dollar niche, mainly in the United States and Asia, which are at the forefront in this business segment. Needless to say, we will be coming back to this in a future feature entitled The uberisation of retail!

[(SUITE DE NOTRE DOSSIER

- SWATCH, CONSTANTLY BREAKING THE MOULD

- MOVADO GROUP: “PERCEIVED VALUE IS THE KEY TO FASHION”

- GUCCI: “THE AVERAGE AGE OF OUR CUSTOMERS IS FALLING DRAMATICALLY”