Beside the keyboard as I type these words there rests a watch. It is mounted within a sticky, spongy, sky blue rubber strap. The instruction leaflet for its assembly and start-up was written in Anglo-Chinese, if you know what I mean, and my daughter, with her nimble fingers and techie brain, was able to follow it. She had the watch going in a moment, and days later it appears to be keeping good time.

The watch retailed in a small local supermarket at … 0.99p.

We can all arrive at different conclusions from this humble little scene. I just note that no watches are manufactured in the UK, beyond a handful from gifted individuals (of whom more later), and so this market focus is necessarily upon the market for imports, where they are sold and what it takes to get them into and out of the stores.

The British economy

And so, first, I observe that here in England the economy has given us a good few years of stability, and watch sales at all price levels have improved year on year. There are however one or two straws blowing about in the nation’s economy to be taken careful note of. Political uncertainties have been generated over the last few months by Tony Blair, and also by his (probable) successor, Gordon Brown, as main policy changes continue to disappoint, and in many cases actually unravel. These were highlighted by a sudden increase, on 11th January, in the Bank of England’s Base Rate of interest. It is now 5.25%, after three hikes in six months. The Chief Economist of the Royal Bank of Scotland called the decision “one of the biggest shocks in the history of the monetary policy committee”, in the 11 years of its independence from central government.

But it was preceded of course by the Christmas trading period. Official figures have shown that the total retail figure during December rose, year on year, by 4.7% to £33.4bn. But there was household discipline being exercised nevertheless. Credit card spending in 2006 fell by £1.8bn, which, according to the British Bankers’ Association, was the first annual fall since records began in 1993. One integrated aspect on these figures is of great interest: shoppers spent £7.66bn online during the 10-week period running up to Christmas Day. This was a 54% increase on 2005. The British Retail Consortium has calculated that purchasing via the Internet accounted for about 9% of the total retail spend in 2006.

So, how has it been for watches? Mintel, the marketing intelligence consultancy, estimates that the UK market in 2005 was worth £735m (up by a surprisingly low 16% on the year 2000), and highlights the fact that volume sales amounted to 18.45m units. Figures for 2006 have yet to be published.

The Swatch Group

Central to all watch industry overviews is the performance of the mighty Swatch Group. Its 2005 Annual Report divides its many brands into five categories (see Swatch Group watch brands). Late last month the group announced that its sales during the calendar year 2006 exceeded CHF 0.5bn for the first time. Swatch Group UK had sales of £18.135m in 2005, of which pre-tax profits amounted to £1.695m. In that year, Breguet, Longines and Rado increased their market share, while Omega enjoyed an outstanding year. The latter brand opened new outlets at London Heathrow, Old Bond Street, Geneva and in the Royal Exchange in the City of London. Doubtless the forthcoming Omegamania auction to be held in Geneva on 14/15th April this year (in which each of the 300 lots in the lavish catalogue will carry a two-year factory guarantee) will yet further the brand’s image and reputation.

In 2006, Omega followed a well-worn path among luxury brands by drastically cutting down the number of retail outlets it supplied. There were 100 of them, and a further 70 were put on notice to improve their sales performances. The UK is cock-a-hoop with winning the Olympic Games for 2012 (although its costs seem to be ballooning by the month). Omega will be the Official Timekeeper for the Games, and no doubt countrywide window displays when the event opens will be eye-catching, even as this country struggles to win just a single gold medal.

In the UK the luxury sector is commonly designated as including wristwatches retailing at more than £500. Mintel estimated in December 2005 that this sector accounted for just 3% of volume sales (of which 79% were quartz analogue models), but 54% by value. The 2006 Swatch Group preliminary results mentioned confirm this profile: “As in previous years, the most substantial sales growth was in the luxury watches segment, which once again enjoyed strong demand.”

News from the UK

Swiss watch manufacturers are continually finding new avenues into the retail market for luxury wristwatches. A recent and shared one has been to connect with legendary car marques. The latter include Audi (Stephen Webster, a jeweller with Swiss made watches), Bentley (Breitling), Bugatti (Parmigiani Fleurier), Maserati (Audemars Piguet), and Mercedes (TAG Heuer). Retailers here love the watches, but cannot get enough of them!

Supply problems have also affected Panerai in the UK from time to time. This brand has now, it appears, reached the status of ‘cult watch’. Richemont must be very pleased their with acquisition in 1997 of this unusual Italian brand (founded in 1860), though its subsequent investment costs have been heavy, with the establishment of its own manufacture. Panerai supplies just 18 outlets in the UK, of which the most prominent are the Watch Gallery and Wempe, both in central London.

DeWitt is a recently established watchmaker, which is in the process of moving to a new factory in Vernier, near Geneva Airport. Vertical integration is its ultimate aim. Already a winner of awards, the brand can now be tracked down in Harrods and selected Watches of Switzerland branches. A good start.

New young watchmakers

New young watchmakers are emerging in the UK – all of them inspired by the great George Daniels, and his genius, dedication and perseverance. Leading the pack perhaps is Roger Smith who, coincidentally, lives on the Isle of Man, where George dwells. I asked Roger (R.W. Smith or Roger W. Smith on his watches, with the Isle of Man and the number on the movements) for a few words on his career to date:

“My watch production to date has been fairly limited and has consisted mainly of one-off pieces. During my three years working with George Daniels we made 50 wristwatches which are known as Millenniums. Signed Daniels London, one of the set recently sold at Sotheby’s, London, for £74,000. I completed my own first series of watches, Series 1, in 2004, and three of the nine retrograde pieces sold through Theo Fennell, the London retailer.

“Due to the imminent delivery of the first piece from my latest series, Series 2, this year’s production will rocket from the usual two to three pieces to about 20. The watches in this series are available directly from myself at an entry level price of £35,000. With the exception of the balance springs, mainsprings, sapph-ire crystals, jewels, and some screws, these timepieces are made entirely in my Isle of Man workshop. They contain George’s escapement, the co-axial, and are the first high-grade production wristwatches to have been made in the British Isles for very many decades.”(www.rwsmithwatches.com).

And now for a note on two sets of brothers who are joining this happy band of UK makers. The first are (really!) Nick and Giles English, whose first watches go on sale this summer at the Watch Gallery in London. The name on the dials is however Bremont, and it is destined to be an aviation brand. Flying is a consuming passion of them both, and also of their father Euan (who was killed in an air accident). No more than 1,000 of each of the first three models will be produced at the Biel/Bienne workshops, after three years of development and rigorous testing. They will be the ALT1-C, ALT1-P, and ALT1-Z. Niche collectors should note these details.

So where did the dial name Bremont come from? From the family of a French pea farmer in France’s Champagne region, in whose field the English brothers were forced to land their 60-year-old plane in bad weather. Antoine Bremont was a former World War II pilot, with a passion for horology. Voilà!

Whilst on the subject of dial names, how does McGonigle read? Irish to me. John and Stephen McGonigle are indeed Irish, and work out of Athlone and Neuchâtel perfecting tourbillons, with all final assembly and finishing of the 110-hour power reserve pieces being carried out in Ireland. They have a sister, Frances, who is in on the act, because she engraves the backs of the mainplates.

The brothers have worked for years in top workshops in Switzerland, including Christophe Claret, and the first fruits of their long endeavours and ambitions reach the UK market this spring. (www.mcgonigle.ie).

Independant retailers

Non-chain retail outlets are always keen to consider outstanding timepieces for their stock, in the full knowledge that there will not be any back-up promotion and advertising activity. This is why Marcus Margulies chooses to stock Greubel Forsey and Urwerk, for example, in his luxurious Bond Street emporium Marcus (See sidebar). William & Son, in Mayfair’s Mount Street, is an exclusive stockist of one of the young giants in Swiss watchmaking today. His name is François-Paul Journe, of whom every serious collector of complicated timepieces has heard much. The shop’s owner, William Asprey, is a shareholder in and Chairman of British Masters, a Swiss maker of the Arnold and Graham brands, which he has done much, quite naturally, to promote. This luxury sporting goods shop also stocks Audemars Piguet, Franck Muller, Jaeger-LeCoultre, and (its most recent prize) Piaget. William is honest in reporting to me that his trading in watches over the Christmas period “was not as consistent as last year’s”.

Over at Patek Philippe’s UK distributor, Rhone Products, CEO Mark Hearn has a better story to tell. “Our December ‘sell-out’ figures tell that this was the best month we have ever had.” That means watches actually sold out of his exclusive outlets around the country. And he ran out of stock of the Twenty-4® in its stainless steel version.

One of the leading stockists outside London of the Patek Philippe brand is George Pragnell… and thereby hangs a tale! To celebrate the 50th anniversary of George Pragnell, in Stratford-upon-Avon, Patek Philippe created a special limited edition of a minute repeater wristwatch for the company. This came about because Jeremy Pragnell (son of the eponymous founder and now Chairman) trained with the renowned Swiss jeweller Meisters in Zurich some 35 years ago. With all his savings counted up, he ordered a Patek Philippe Calatrava. It was personally delivered to him by one Philippe Stern. Today Mr. Stern is owner and President of Patek Philippe.

George Pragnell store and Wempe store

George Pragnell stocks 14 top brands, such as Cartier and Rolex. Shakespeare’s home town gets a healthy year-round footfall after all. Jeremy Pragnell (whose own son Charlie is now in the business) was one of the first regional outlets to take on Panerai and A. Lange & Söhne. Jeremy Pragnell has one answer to his success: “The level of knowledge and awareness amongst our customers means our standard of service at point-of-sale has dramatically increased. This is reflected by the increased geographical spread of our customer base, with many travelling from upwards of 100 miles away and even from London to see us.”

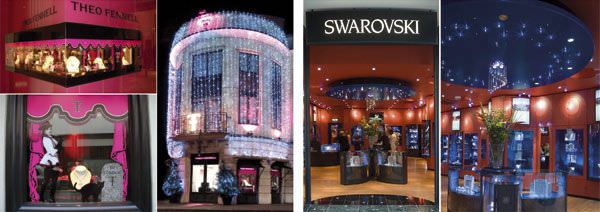

Theo Fennell, the jeweller and watchmaker (well, wristwatch supplier), based in his exotic shop in London’s Fulham Road, is a publicly quoted company (and indeed rumoured to be seeking a buyer). It reports a bumper Christmas, with small slices of giant City of London seasonal bonuses coming its way, and through its other outlets in Harrods, Harvey Nichols, and naturally in the City itself, in the wonderful Royal Exchange, which also houses Cartier, Tiffany, etc. Fennell’s sales in the three weeks to 29th December 2006 increased by 29%. It reports seeing Russian visitors in serious numbers, with seriously fat wallets, which were stuffed with serious actual cash. Theo Fennell has a branch in Moscow, for those who just couldn’t get away (understand me?).

Family-owned Wempe has very many de-luxe retail outlets spread around the major cities of present-day Germany, but just one store in London. And it is on the move. At the end of this summer it moves from 135 to 43 - 44 New Bond Street, and will be three times its present size. A good way to celebrate Wempe’s 10th anniversary in London. Watch aficionados need no reminding that Old and New Bond Street is the place to wander up and down, both sides. These days Sloane Street is running in a close second: more than 30 shops offer luxury timepieces, but mostly their own brands.

The big beast among UK watch and jewellery retailers is the publicly quoted Signet Group. Pre-tax profits at its coming year-end are expected by analysts to be in £205m - £212m bracket, with some three-quarters coming from its US Kay operation. H.Samuel and Ernest Jones are Signet’s main UK shop fronts. Ernest Jones, its more upmarket business, recorded a low Christmas period increase in sales of only 0.4%, and, somewhat surprisingly, Chairman Terry Burman blamed the result on low watch sales.

Theo Fennell store and Swarovski store

Sparkling results would of course be expected from Swarovski, the world’s leading manufacturer of crystals (and still family-owned). General Manager James Howard is expanding its retail chain fast, and now operates 34 stores and 15 franchises. He opened a new outlet in Edinburgh before Christmas, and enlarged its hugely successful branch within the very large Bluewater shopping mall in Kent. Bluewater was one of the first shops Swarovski opened eight years ago. Its London flagship store is in Regent Street. Its crystal set watches are unlike any other on the market, and James Howard has big ambitions for this delightful company in a niche market all to itself.

Chain stores

And now some news of the big watch and jewellery chains. In November 2005, Baugur Group acquired MW Group for £21m with intention of merging it with its Goldsmiths operation (bought in 2004 for £110m). MW Group is one of the UK’s leading retailers of luxury watches and fine jewellery, with over 230 years of trading behind it. The Group has 32 stores across the UK under two separate brands, Mappin & Webb and Watches of Switzerland. Goldsmiths and the MW Group will together control over 200 stores, and have sales approaching £300m. Justin Stead is the new CEO of the combined enterprise, and has the responsibility for bringing his stores back into profit after a recent refinancing.

Out of the box of Europa Star archives 1937 - 1940

Interesting facts on the United Kingdom

In 1937 England imported 7,348,485 watches and finished movements from Switzerland with a total value of CHF 27,000,000.

In 1938 the speaking clock brought in £85,000 and replied to over 20,000,000 telephone calls.

In 1938, 400,000 couples were married in England and 8,600,000 families received revenue under £4 per week.

In 1940 six million clocks and eight million watches were sold in England.

In 1940, during World War II, wristwatches for men had almost disappeared from the stores and most of London’s stock of diamonds was buried under the rubble from the bombing, doubling the price of these precious gem stones.

For additional information on George Pragnell, click HERE

Source: Europa Star February-March 2007 Magazine Issue