ecently, the luxury world in particular has been over-ambitious, opening store after store, leading us consumers to believe that renowned luxury brands want to transform themselves into US fast-food chains, with a shop on every corner. The difference being that you won’t be served a burger, but instead a luxury watch, leather bag or some other stylish accessory.

To understand what we are looking at when comparing Apple’s stores to other successful companies in this field such as Louis Vuitton one has to dive into the numbers.

- Louis Vuitton operates 460 stores and has an operating margin of 19.1% (est. 2017).

- Apple operates 498 stores and has an operating margin of 26.8% (source: Yahoo Finance).

Louis Vuitton has around $10 billion in revenues (est. 2017) and sells all of its goods in its own stores, while Apple earns revenues of $229 billion and sells around $31 billion of goods in its own stores, considering average store size multiplied by estimated profitability per square foot.

This means that each Louis Vuitton store on average makes $21.7 million in revenue per year, and each Apple store around $62 million. Let’s also keep in mind that total e-commerce (online shopping) for Apple devices accounts for only 14% of Apple’s global revenue. Currently, the estimated global average value of online sales in relation to total retail is estimated at around 11%. Apple, the most valuable company in the world, has been beating the global average for many years.

The flagship store, in the form of a monobrand boutique owned by a brand manufacturer, is one of the latest myths to arise out of channel conflicts and the nasty e-commerce wave.

So, as we can see, it’s pointless trying to mimic Apple’s behaviour, because even the best brand manufacturers in the field, like Louis Vuitton, Hermès or Chanel, cannot get close to Apple’s numbers.

The difference between Apple’s sales and those of most other online retailers is that Apple does not provide a single dime of discount through its online store… Which leads me to another observation, after talking to numerous brands; non-discounted online sales of a typical luxury brand (assuming they have an online shop) account for approximately 1-2% of that brand’s total revenues!

Take it or leave it, but if e-commerce is hailed as the holy grail of luxury, you must first look at how many luxury watches are sold without discount, at regular RRP and through the entire marketplace, before basing your brand’s future strategy on Apple’s success numbers. As always, there are brand exceptions, especially in the super high-end margin market, but in general the averages are the most reliable indicator.

It is pointless trying to mimic Apple’s behaviour, because even the best brand manufacturers in the field like LV, Hermès or Chanel cannot get close to Apple’s numbers.

But let’s get back to the flagship topic.

So, assuming our numbers are correct, currently an average of 89% of goods are sold via a third-party platform or a physical retailer, and some percentage of this could be filtered through a flagship store. That is, if you have the necessary strength to open your own stores.

Even if you are able to open your own stores, perhaps as a brand you should first keep a close eye on store profitability before opening more and more stores further away from the hot-spot 5th Avenues of the world, where costly branding activities at least create brand value, even if they don’t always turn a real profit.

Again, let’s do some simple numbers.

Let’s assume that fitting out your new monobrand store will cost you $500,000, which can be considered an initial fixed cost. The same would go for an independent retailer offering more than one brand.

The numbers are as follows:

One store ONE brand = 100% cost/brand = 100% risk for yourself

One store TWO brands = 50% cost/brand = 50% risk for yourself

One store TEN brands = 10% cost/brand = 10% risk for yourself

These are very simple numbers, and to simplify things I did not include other costs like rent, staff or inventory, or the fact that the greater footfall caused by having more brands in one place typically draws more people into the location, thus likely resulting in increased sales.

Critics will immediately say that all the margin goes to the brand. Agreed… but also all the risk. Furthermore, positioning a store in the wrong location can eat up all profits from other sales channels. I have never understood why the luxury industry in particular is so sure that they can beat the simple math shown above.

As a brand, you should first keep a close eye on store profitability before opening more and more stores further away from the hot-spot 5th Avenues of the world.

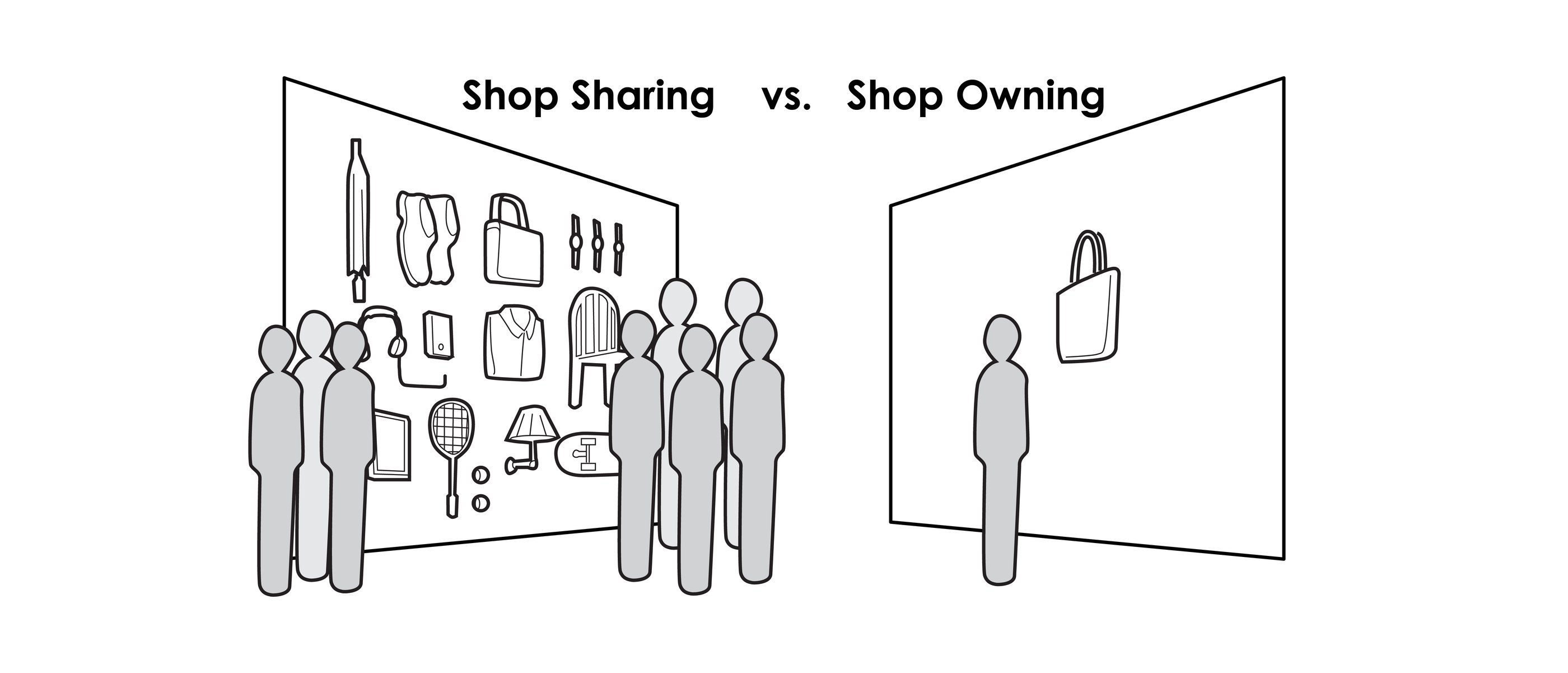

There is nothing wrong with a well-designed and luxuriously furnished boutique where friendly and well-trained staff serve us a glass of champagne to accompany our shopping frenzy. But perhaps as a brand, if you can’t afford to spoil your customers the costly monobrand-store way, you might want to think about shop sharing instead of shop owning. This means we need to rethink the business model of retail once again.

Also, I wouldn’t be so sure that today’s customers feel particularly comfortable in “monoculture” stores.

-

- Andreas Felsl – creator and thinking brain behind BrandCloud

- Andreas Felsl has founded, built and run companies in the world of mechanical watches, sporting goods and the software industry. He has among others founded the watch brand Horage. With his new project BrandCloud, he now works hard on answering the “28-trillion-dollar” question of how to reach the state of Omnichannel-Retail. A state in which there is no difference between online and offline commerce, relieving us from today’s shopping paranoia caused by commerce out of control.