peaking at the German jewellers’ congress last October, Dr Guido Grohmann, chief executive of the Federal Association of the Jewellery and Watch Industry (BVSU), declared: “During the period from last summer to this year’s summer holidays, as shops have reopened, we can look back on an exceptional year across the board and particularly in the high jewellery and luxury watch segments.”

It’s a sentiment echoed in the United States, Asia and other European countries, as confirmed by Mercury Project’s “SO8 Sell-Out Index” which monitors sales at watch and jewellery retailers in the eight main markets. This index rose 9.8% over the first three-quarters of 2022 versus the same period in 2021. It’s interesting to note that numbers have already exceeded pre-pandemic levels, gaining an impressive 20% compared with the first three-quarters of 2019. China, Hong Kong and Macau, impacted by their zero-Covid policies, and the United Kingdom, harder hit by the cost of living crisis, were the only markets not to benefit from this upturn.

Increased monobrand openings

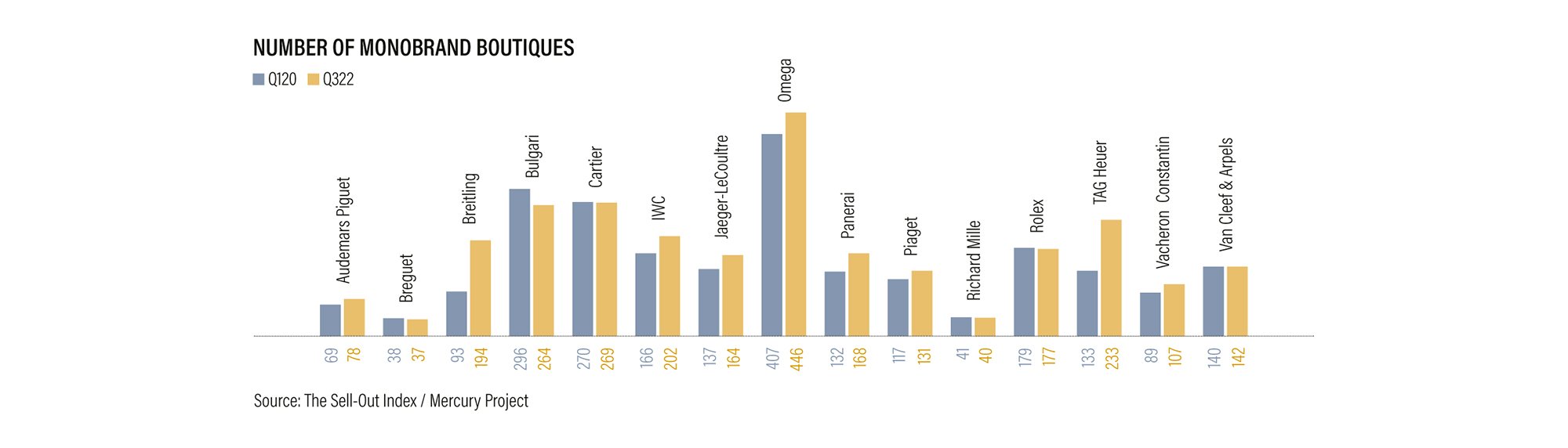

Over the past two years, many leading watchmakers have focused on opening monobrand stores, which they operate either themselves or with a retail partner. As part of an omnichannel strategy, these boutiques enable brands to directly engage with customers, better understand their expectations, and adapt production and investments accordingly.

Numerous brands – Audemars Piguet, Breitling, IWC, Jaeger-LeCoultre, Omega, Panerai, Piaget, TAG Heuer, Vacheron Constantin and seemingly Tudor – have restructured their distribution network to include more monobrand stores, in what is an ongoing trend. Cartier plans to open a dozen Cartier boutiques in the United States over the coming years. Some brands have embarked on a spree of openings: Breitling says it has been opening up to two stores per week this year; Panerai is opening one every two weeks. Both Kering (Boucheron, Pomellato, Qeelin) and Hermès Watches favour direct-to-consumer sales over selling through third parties.

This trend is clearly borne out by Richemont’s interim results. Growth for the first half-year (ended September 30, 2022) was driven by sales in the Swiss group’s 1,283 directly operated stores. These increased by 30% at actual exchange rates and by 21% at constant exchange rates. This channel currently represents 67% of group sales versus 57% in the previous financial year. In contrast, sales by franchises, multi-brand retailers and agents increased by just 6% at constant exchange rates.

Supported by major retailers

Similarly, the leading watch and jewellery retail chains are expanding their presence. Bucherer, Watches of Switzerland, The Hour Glass, Cortina and Wempe are all developing brand franchises. In China, retailers such as Chow Tai Fook, Luk Fook and Chow Sang Sang are doing the same. Partnerships with brands take various forms, from geographic expansion to acquisitions and new offerings, and imply contractual relations that require more attention and interaction, as well as more resources than in the past.

While continuing to expand its footprint in the US market, Watches of Switzerland is elevating its presence in Europe, initially with its sights on Scandinavia and Ireland. The group currently operates 173 points of sale. This includes 58 brand boutiques compared with 20 three years earlier.

Also in the United States, Bucherer continues its rebranding of Tourneau showrooms as Bucherer (following its acquisition of Tourneau in 2018). The Swiss chain has also purchased Leeds & Son Fine Jewelers, a California retailer anchored by Rolex and Patek Philippe. In Frankfurt, it has cut the ribbon at its first ever fine jewellery boutique. Elsewhere, the Pandora group, which is the world’s largest jewellery chain by number of points of sale, has acquired the 34 locations of its Portuguese distributor.

The momentum is strongest in China (still with no certainty as to when the country will re-open its borders for nationals). Hong-Kong-based jewellery chain Luk Fook, which is partner to Swatch Group brands, will have added 500 outlets (mainly franchises) to its network during 2022, although local competitors are keeping pace, including Lao Feng Xiang (+110 stores), Chow Tai Fook (approx. +300 stores) and Chow Sang Sang (+100 stores). The latter two are both authorised Rolex dealers. Swiss brands have also been busy in the region, for example Omega (+50 boutiques in two years), Breitling (+35 boutiques in two years) and TimeVallée, part of the Richemont retail channel, which has announced the opening of a new store in Shaoxing, in Zhejiang province. The most active distributors are now looking at Tier 2 and Tier 3 cities.

Faced with uncertainty in China, India and even Nigeria offer fresh opportunities for growth. Local players such as Kapoor, which has a fleet of 13 stores, and Ethos, which recently went public on the New Delhi stock exchange, and has announced plans to open 35 stores in the next three years alongside the 48 existing locations, are key to entering the difficult Indian market. In Nigeria, a growing number of prestigious Swiss watchmakers are partnering with the Polo Luxury group.

In the pre-owned market, online platforms are branching out into brick-and-mortar locations. Following on from openings in Europe, WatchBox has cut the ribbon in New York City. Meanwhile, Watchfinder & Co. has a concession inside the Printemps Haussmann department store in Paris as a complement to its presence in Richemont brand stores. Multi-brand retailers are also keen to take a share of this promising market (Deloitte estimates that by 2030 the pre-owned market will be worth CHF 35 billion). Like Bucherer, which has rolled out its offering of pre-owned watches in several countries, Westime has opened a pre-owned luxury watch lounge above its Beverly Hills showroom in California.

Renovations and new concepts

Another priority is the development of distinctive retail destinations. Watches of Switzerland has introduced a fresh design for its Goldsmiths stores in the United Kingdom, while Signet Jewelers has updated the identity of its Ernest Jones stores. Swarovski has unveiled a new concept store in Macau, as has Mikimoto in the United States.

As stores were shuttered for global lockdowns, a lot of brands put these two years to good use and have renovated their flagship stores. Notable examples are Cartier in Paris and New York, and Chanel Horlogerie also in Paris. Others have taken advantage of opportunities in real estate to relocate. Singapore’s Sincere Watch has reopened its landmark Sincere Haute Horlogerie (SHH) at a new address. In New York City, Chopard has moved its flagship from Madison Avenue to Fifth Avenue.

Customer engagement is high on luxury brands’ agenda and can sometimes take surprising forms. Louis Vuitton, for example, has inaugurated its own restaurant in Chengdu, China. Montblanc has opened its Suite 4810 concept on the Champs-Elysées in Paris. Jaeger-LeCoultre has introduced its Reverso 1931 Café at various global locations, while Franck Muller has its very own pâtisserie in Tokyo’s Ginza district.

Cutting back on multi-brand retailers

“As long as our retailers are doing a good job, I have no plans to do it [for them]. I prefer to focus on making watches. But as soon as it’s no longer the case, I’ll open my own stores,” Thierry Stern, President of Patek Philippe, declared in a recent interview with NZZ. Patrick Pruniaux is head of Girard-Perregaux and Ulysse Nardin. Questioned by L’Agefi, he noted that, “We have cut our network by half over the past four years. We have maintained longstanding partnerships but have also added leading retailers who invest in their stores and in staff training.” Retail is being increasingly squeezed by brands, many of which are pulling out of multi-brand points of sale.

Like their luxury counterparts, the more affordable brands are equally focused on optimising their geographic presence, and on rationalising and upgrading their network by reducing the number of stores, giving priority to monobrand boutiques and digital channels. Over a three-year period, TAG Heuer has cut the number of its stores from more than 3,000 to 2,500. Louis Erard has closed more than 300 of its 400 points of sale while growing its online business.

Smaller independent brands, positioned above CHF 10,000, are adopting a similar tack, all the while taking advantage of the fact that big brands are withdrawing from multi-brand distribution. Out of a panel of 36 brands, each present in fewer than 100 stores, the average number of closures per brand in two years comes to 15 versus 11 openings. Arnold & Son, Greubel Forsey, MB&F, H. Moser & Cie. and Jacob & Co. are among those independents to have extensively restructured their network through changes to and reductions in the number of retail partners. A handful of local retailers offer a level of expertise and a loyal clientele of connoisseurs that have made them essential distribution partners for these high-added-value makers. They include the likes of Cellini in New York, Ahmed Seddiqi & Sons in Dubai, Berger in Mexico City, Chronopassion in Paris or Stephen Silver in California.

Some retailers have taken decisions with important strategic consequences. For instance, Gübelin went on to transform its Lucerne boutique into a TimeVallée store.

Sometimes, decisions are made in response to the geopolitical context. Despite having invested substantially in China, the South-Korean Lotte conglomerate has pulled out of the Chinese market after diplomatic quarrels between Seoul and Beijing sparked a campaign to boycott its businesses. Like Covid or the war in Ukraine, geopolitical, health or environmental factors can have significant and unforeseen consequences on the global watch distribution landscape.